Active traders utilizing margin appear to be moving to the sidelines as Bitcoin continues trading sideways.

This trend is clear while looking towards the cryptocurrency’s perpetual swaps volume, which have declined by over 52 percent over the past 30 days.

This decline has come about in tandem with Bitcoin’s price settling within the lower-$9,000 region, and this could be contributing to the market’s persistent bout of sideways trading.

Because the benchmark crypto’s price action remains firmly controlled by active retail traders, watching to see when this trend starts shifting could offer significant insight into when Bitcoin will begin breaking out of its multi-week consolidation pattern.

Bitcoin perpetual swap volume plummets as consolidation channel strengths

Bitcoin has been trading between the upper-$8,000 region and the lower-$10,000 region for the past several weeks.

This consolidation phase has done little to offer investors with insight into the direction that the market will trend in the days and weeks ahead, with each bid to break $10,000 being met with heavy selling pressure while buyers ardently defend $9,000.

This period of range-bound trading may be primarily rooted in the lack of trading volume seen while looking towards the cryptocurrency’s perpetual swaps.

These contracts account for a significant amount of Bitcoin’s volatility due to them being used across all margin trading platforms.

According to data from blockchain visualization took IntoTheBlock, trading volume for BTC’s perpetual swaps volume declined by 52 percent over the past 30-days.

“Bitcoin perpetual swaps volume saw ~52% drop during the last 30-days. This decrease in the volume of the perpetual swaps correlates with the price decrease of Bitcoin during the last month. Almost $17b were transacted in Bitcoin perpetual swaps on June 11, the 30-day high.”

Data via IntoTheBlock

Data via IntoTheBlock

Here’s what on-chain data says about the key levels investors should watch

Once Bitcoin’s perpetual swaps start seeing climbing volume, there are a few key levels investors should closely watch.

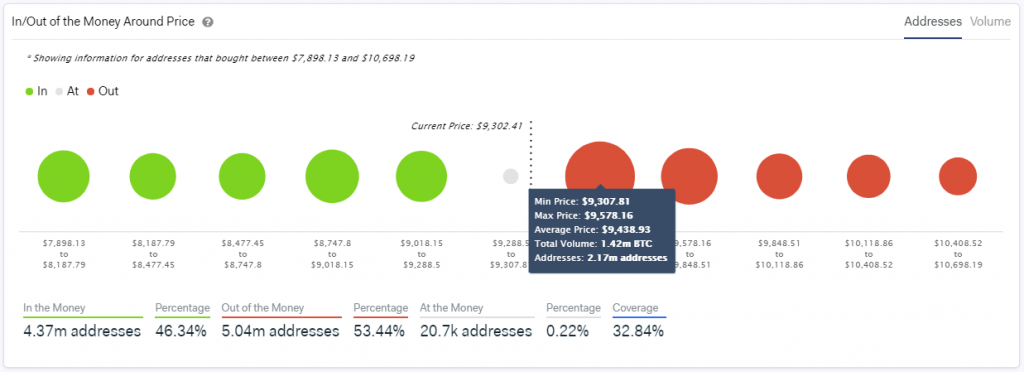

According to IntoTheBlock’s IOMAP indicator – which analyzes the price levels at which most investors entered their BTC positions – $9,600 is the first crucial level that bulls must break if they intend to catalyze further upside.

On the flip side, sellers could catalyze a fresh downtrend if they are able to push Bitcoin below $9,000.

Data via IntoTheBlock

Data via IntoTheBlock

IntoTheBlock spoke about the importance of this level in a recently released report, saying:

“Nearly 1 million addresses had previously purchased a total of 559k BTC between $9,018 and $9,288. This is expected to act as a strong support as holders in this range will attempt to remain profitable on their positions and push prices above this level.”

Once Bitcoin begins nearing one of these key levels, it is possible that its perpetual swaps volume will begin picking back up, thus causing it to see some clear and decisive momentum that puts a firm end to its long-held trading range.

The post Why Bitcoin’s perpetual swaps volume crashed by 52% over the past 30 days appeared first on CryptoSlate.