Bitcoin’s trading volume has been sliding slower throughout the past several months as it continues trading within an incredibly tight trading range.

This range has been compressing throughout the past few weeks, with BTC now respecting $9,000 and $9,300 as two short-term range boundaries.

New data suggests that this lackluster price action seen by the benchmark cryptocurrency may be coming about as a result of the trading volume being directed away from BTC and into altcoins.

If this is the case, then Bitcoin may not be able to break its tight trading range until capital begins cycling away from altcoins and back into the benchmark digital asset.

Bitcoin’s trading volume dives as volatility reaches historic lows

Bitcoin’s volatility has seen an unprecedented decline throughout the past several weeks.

The crypto’s consolidation trend first began in early-May, with BTC rapidly developing a tight trading range between $9,000 and $10,000. Each break above or below this range has been fleeting in the time since.

This volatility has sidelined many active market participants, causing trading volume to fall into an intense downtrend.

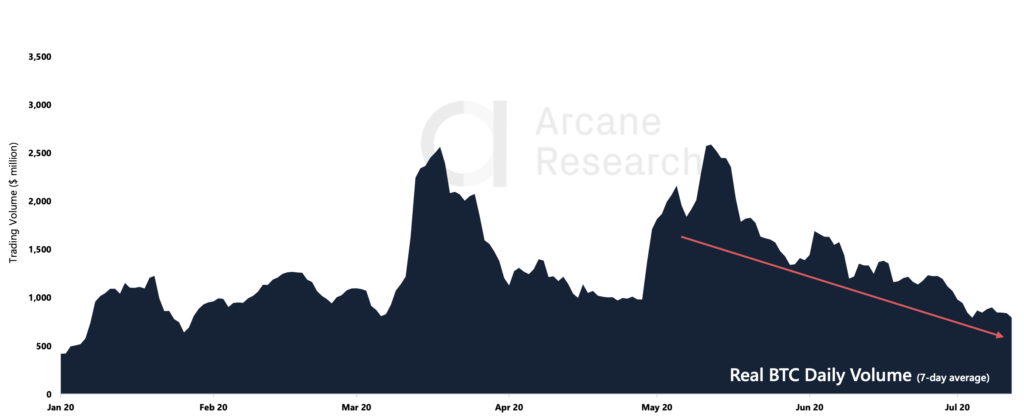

Arcane Research provided data relating to Bitcoin’s trading volume in a recent research report, offering a chart showing this decline while adding that the trend is “concerning.”

“The 7-day average real trading volume continues to trend downwards this week… While the overall trading volume in the crypto market is looking more stable than the bitcoin volume, it is certainly concerning to see this steady downwards trend…” they noted.

Data Source: Arcane Research

Data Source: Arcane Research

According to data from analytics platform Skew, Bitcoin’s daily trading volume on Coinbase has been incredibly low over the past month, averaging at $74 million.

Bouts of low volume and volatility are typically short-lived, but this current trend isn’t showing any signs of shifting anytime soon.

Altcoin’s gain a growing share of the crypto market’s trading volume

The source of the exodus of trading volume that Bitcoin has been seeing could be altcoins, which have been gaining heightened control over the market’s volume dominance.

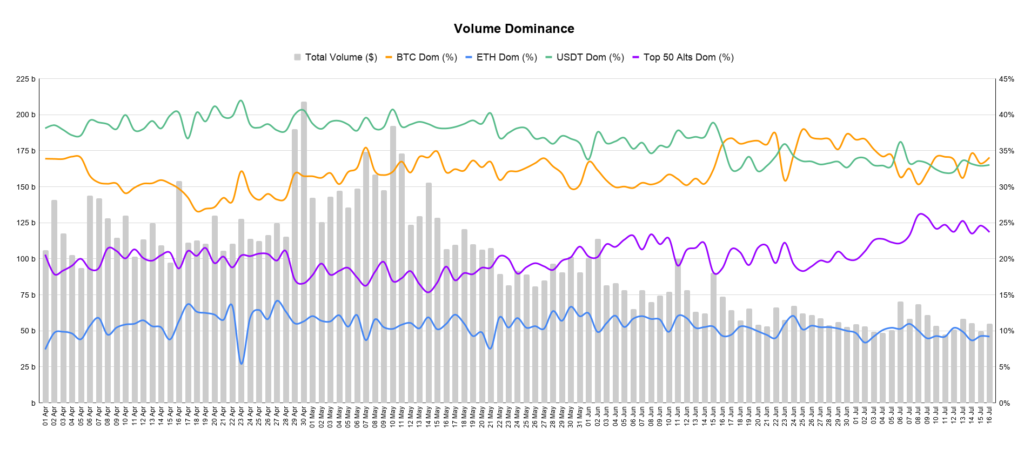

One popular pseudonymous trader who trades under the name “Hsaka” offered a chart showing the rise in volume dominance that altcoins have been seeing as of late.

“Volume Dominance of BTC, ETH, USDT and the top 50 alts for the past 4 months. While total volume has been bleeding out, alts have started to grab a larger share for themselves.”

Image Courtesy of Hsaka.

Image Courtesy of Hsaka.

Until the cycle of investors moving their capital towards altcoins begins to revert into Bitcoin’s favor, its sideways trading will likely be heightened by declining trading volume.

The post Bitcoin’s trading volume is shifting towards altcoins as BTC flatlines appeared first on CryptoSlate.