This is a significant number as it is close to 10% of the total circulating supply of Ethereum despite the digital asset hitting new all-time highs. This metric shows that investors believe ETH price can rise higher in the short-term and long-term, otherwise they wouldn’t have locked their coins away.

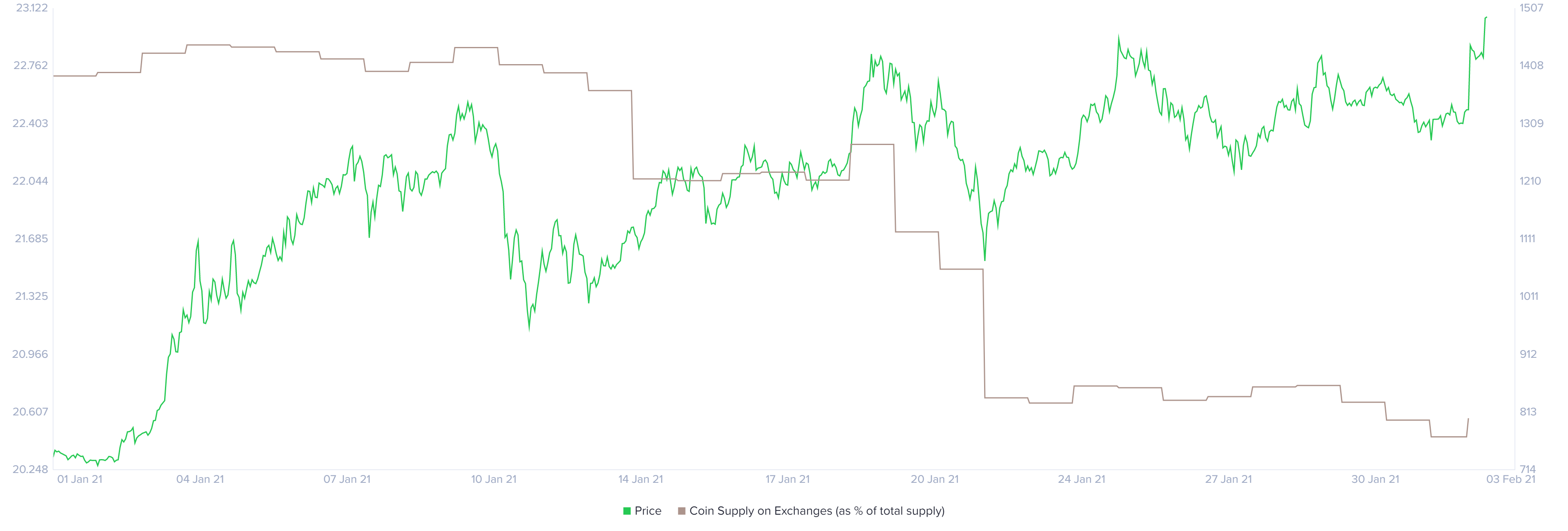

In fact, the number of ETH coins inside exchanges also dropped considerably in the past month. On January 1, around 22.7% of the circulating supply of ETH was inside exchanges. Now, only, 20.57% are held by exchanges, a significant drop despite Ethereum price rallying. This again shows that investors are not afraid to hold.

Ethereum price can quickly climb towards $1,900

This recent breakout seems to have a potential price target of $1,900. On the daily chart, we can draw an ascending wedge that has a 27% breakout target which would put ETH price at $1,900 in the long-term.

The breakout of the pattern is clear as Ethereum hit a new all-time high and touched $1,500. However, we still need to see enough continuation above $1,500 to be comfortable. Although a rejection from $1,500 would denote weakness, as long as the bulls can hold the 12-EMA on the daily chart, the uptrend can continue.

Losing the 12-EMA at $1,350 would be significant and will shift the odds in favor of the bears potentially setting a double top on the daily chart. Bitcoin also had a significant 5% move today towards $35,500 and the entire market has turned bullish.

.

Follow CryptoTicker on Twitter, Telegram and Youtube for daily crypto news and price analysis  Ethereum Price Analysis© Cryptoticker

Ethereum Price Analysis© Cryptoticker