Grayscale Investments announcement on Feb 26 about exploration of different altcoin investments products will likely ignite an astronomical rally and result in a proper altseason, multiple analysts are claiming.

We're always seeking ways to better meet growing investor demand for exposure to digital assets through familiar, secure, and regulated investment products. That's why we're considering several new digital assets for potential new product offerings. https://t.co/U3fTKIb5SG

— Grayscale (@Grayscale) February 26, 2021

In an altseason provoking news, Grayscale published a long list of altcoins being up for consideration stating that they want to offer institutional investors more choices. The non-exhaustive list of tokens being up for review and final decision is presented below.

These include DeFi blue chips like Aave (AAVE), Chainlink (LINK), Compound (COMP), Maker (MKR), Reserve Rights Token (RSR), Sushiswap (SUSHI), Synthetix (SNX), Uniswap (UNI) and Yearn Finance (YFI).

Other significant assets up for consideration are Cardano (ADA), Basic Attention Token (BAT), Cosmos (ATOM), Decentraland (MANA), EOS (EOS), Filecoin (FIL), Monero (XMR), Polkadot (DOT) and The Graph (GRT).

Why Grayscale Investment Announcement Matters?

Grayscale Investments is the world’s largest digital currency asset manager. It provides fund management services to accredited investors. The Coinbase custody services are used to handle custody of assets under management (AUM).

They currently offer funds for Bitcoin (BTC), Ether (ETH), Bitcoin Cash (BCH), Ether, Ethereum Classic (ETC), Litecoin (LTC), Horizen (ZEN), Ripple (XRP), Zcash (ZEC), Stellar Lumens (XLM).

It’s a vital solution for the funds, family offices, investment groups, high and very high net worth individuals to gain exposure to crypto-assets, without having to worry about the security and custodial issues. Soon, it might be a catalyst for the altseason too.

Why It’s The First Horsemen Of The Altseason?

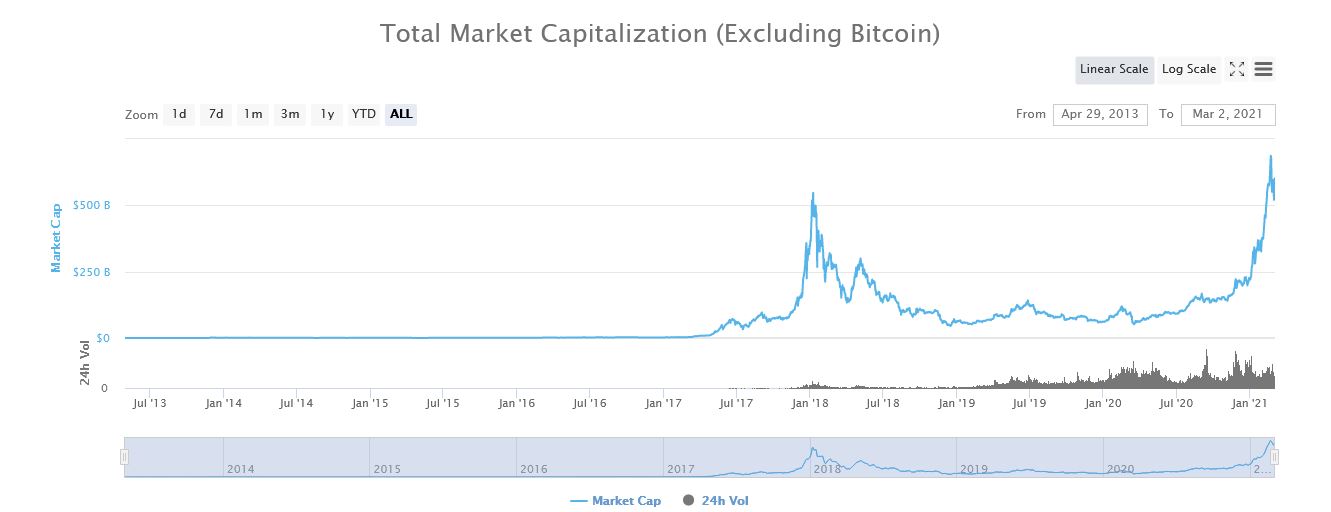

Historically, the altcoin investment has been dominated by retail group and individual buyers. The last altseason of ’17-’18 saw the total market capitalization of all assets max out at $547 billion.

Total Market Capitalization Data Altcoin – Coinmarketap

Total Market Capitalization Data Altcoin – Coinmarketap

However, it already is at $603 billion and the altcoins are yet to exhibit the manic exuberance of the last altseason. And this time, it won’t only be the retail buying into quality projects like the last time.

Grayscale latest announcement and the plans to add a long list of diverse crypto-assets, alongside the traditional large caps is likely to intrigue institutional buyers with a higher risk/reward appetite.

These investors with deep pockets with orders of magnitude higher buying than retail and who previously didn’t have a formal way to acquire these unique assets are likely to ignite a major rally and another proper altseason.

It would be the one eclipsing the previous altseason, since the amount of money flowing into the ecosystem would be higher and likely to cause more impact because of the infrastructure and a long list of investable projects than before.

Altseason Grayscale Investments© Cryptoticker

Altseason Grayscale Investments© Cryptoticker

The post Altseason First Horseman – Grayscale Latest Announcement Will Likely Ignite Rally appeared first on CryptoTicker.