Grayscale Investments plans to convert its Grayscale Bitcoin Trust, the world’s largest such product, into a bitcoin exchange-traded fund.

Today, digital assets management group Grayscale announced its intention to convert the world’s largest bitcoin trust, GBTC, into an exchange-traded fund (ETF) with regulatory approval.

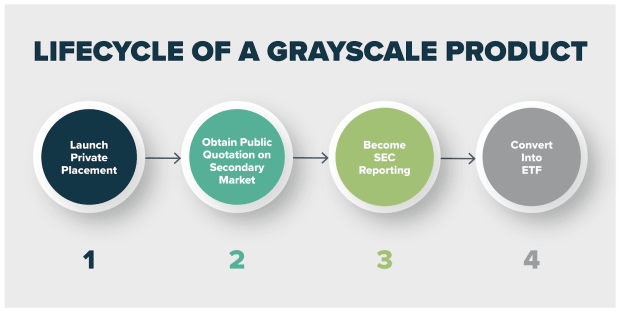

Having launched the product in 2013, Grayscale was a pioneer in the Bitcoin space for providing regulatorily-compliant bitcoin exposure to institutional investors and asset allocators. Currently the only bitcoin fund that can claim to be an SEC-reporting company and with more than $38.8 billion in assets under management, GBTC entering the ETF race is significant news, as there is not any other bitcoin investment product that can boast its regulatory status, track record, size or liquidity. Though many firms are currently seeking approval from the U.S. Securities and Exchange Commission (SEC) to offer bitcoin ETFs, none have received approval to do so.

Grayscale also announced that if the GBTC product were converted to an ETF, its management fees would be greatly diminished, which is welcomed news for investors who currently are paying 2 percent a year to hold the trust. The new management fee that Grayscale would offer, however, was not disclosed.