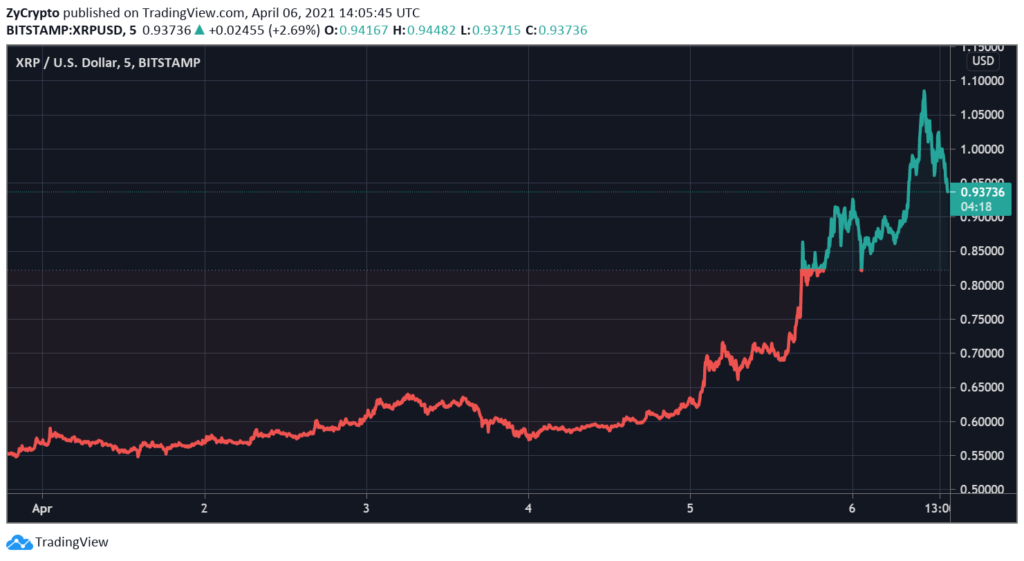

Better late than never. XRP enthusiasts are celebrating the phrase after seeing the digital asset record a late performance early this week. Starting Monday, XRP experienced heightened activity and price explosion.

Trading volume surged by as much as 500% while prices pumped by up to 40%. After opening the week at $0.60, the digital asset hit a daily high of $0.90. It further successfully climbed from 7th place to 4th overtaking Cardano, USDT, and Polkadot.

XRPUSD Chart By TradingView

XRPUSD Chart By TradingView

Previously dismissed by some investors following its woes with the SEC, Ripple’s XRP is gradually making a comeback. Court developments so far indicate XRP is edging ahead. As such, XRP has been making a recovery.

In fact, at current prices, XRP is worth more than when the case was first presented by the SEC. Since the turn of the year, XRP is up by 170%. Of course, the situation remains fragile and a single development could see it crash.

As the court developments have looked encouraging, there has been a call, better yet a movement, created by XRP traders to have exchanges relist XRP. An army of XRP traders has been vocal on social media calling for US-based exchanges to relist XRP.

Bitcoin Dominance On Edge

XRP’s surge is a further indication of a changing trend. Performance from last week has suggested that investors might be preferring altcoins to Bitcoin. Since failing to stay above the $60K price level, Bitcoin’s dominance has been tumbling. At the same time, top altcoins have been performing exceptionally.

In the last 7 days, Bitcoin is up by 2%. In the same period, Ethereum is up by 18% while Binance Coin is up by 38%. As the altcoin leaders, they have set the pace. Polkadot which is seventh is up by 33% in the last 7 days and following Monday’s action, XRP is up by 50%.

These performances have seen the total market capitalization cross over $2 trillion for the first time. If XRP continues moving with the same vigor, it’s not only going to hit the paramount target of $1 but it is destined to set sight on a new all-time high.

Bitcoin’s dominance currently stands at 55.2%. Analysts predict that if it falls below 50%, the market could experience a repeat of the 2018 altseason.