Bitcoin’s price has been declining in the past few days, being almost 20% down during the last week. This saw many people worried if the 2021 bull run is over. One indicator suggests that if history is to repeat itself, the price should continue its upward trajectory following the most recent crash.

- Bitcoin saw a serious decline over the past few days as the price lost upwards of $12,000 over the previous week.

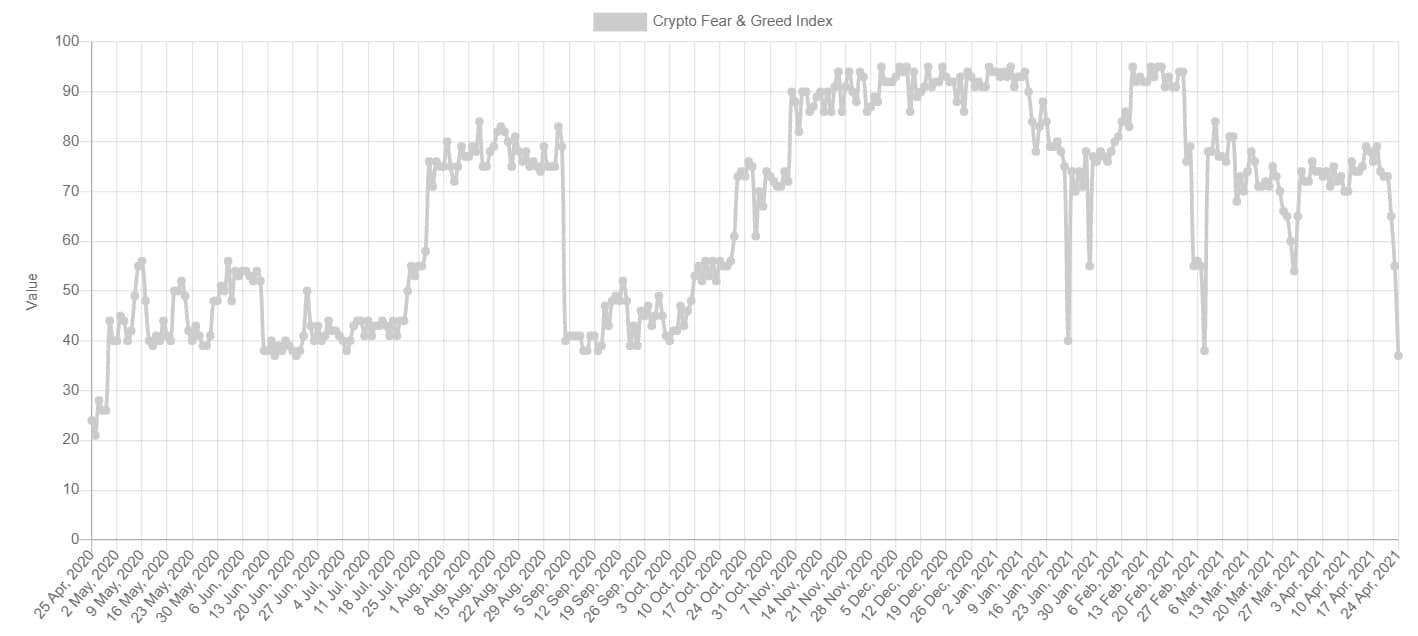

- This has also seriously shifted the overall sentiment, as indicated by the popular fear and greed index.

- For comparison, last week, the market was in a state of “extreme greed,” and now, just seven days later, following the decline, the indicator shows “fear.”

- The current state of the market has been reached a few times in the past several months, and each time it happened, the price bounced back shortly after.

- Commenting on that was popular cryptocurrency trader and analyst, Bitcoin Master, who said that “if this is still a dip, bitcoin should be pulling back up really soon, otherwise it is definitely a change in pattern.”

Cryptocurrency Fear and Greed. Source: Alternative.me

Cryptocurrency Fear and Greed. Source: Alternative.me

- Another thing to take into consideration is the USDT inflow into exchanges. Data from Glassnode revealed that we just saw the largest USDT deposit to exchanges since early February.

- Some analysts believe that this is indicative of institutions and whales buying the current dip.

- As CryptoPotato reported earlier today, at least two on-chain indicators are also favorable of a potential rebound in bitcoin’s price.

- Of course, it’s important to remain particularly vigilant as high volatility also carries serious risks of capital loss.