The cryptocurrency market shows a steady rise after the big sell-off last week after many indicators turned bearish, but are we out of the rough patch yet?

Last week, after the price closed below the 20MA (a popular indicator used by traders to assess the price momentum), there was a huge sell-off which saw Bitcoin prices fall by almost 40% in a single day, inciting panic in the market.

A lot of external factors also seem to have played a role in the drop, especially the ban on cryptocurrency mining announced by the Chinese government.

However, it looks like the market now seems to be recovering slowly as the China-stricken fear, uncertainty, dismissal, gets addressed by the broader crypto community.

In conclusion, #Bicoin mining will exist as normal, except the mining in China will be shifted from industrial-size datacenters to home miners, small or medium sized miners. The entire Bitcoin network will always be strong even its hashrate decline by 50%.

— 江卓尔 Jiang Zhuoer BTC.TOP (@JiangZhuoer) May 24, 2021

Historically there have never been back-to-back big weekly corrections in the crypto market, and analysts expect a steady week ahead.

So what’s next for Bitcoin?

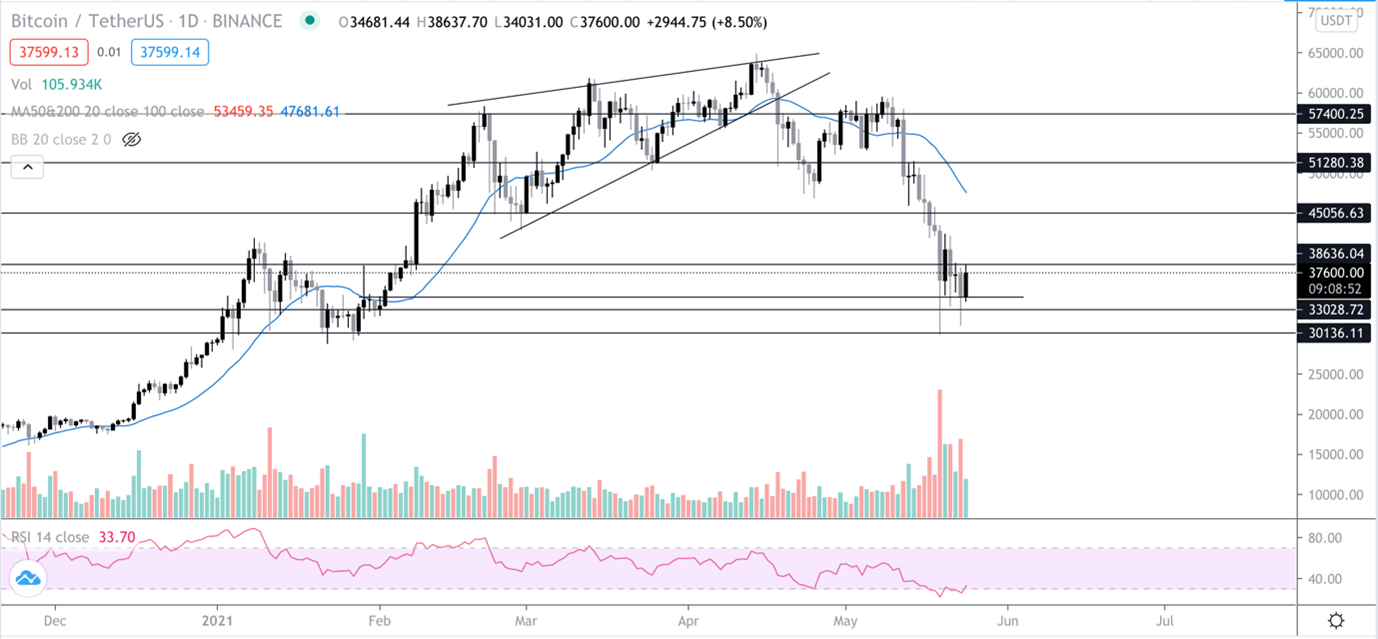

Bitcoin closed yesterday’s weekly above the $33,000 support which indicates that the following week should be steady. However, to get back to the previous bullish momentum, the price needs to shift upwards of $48,000 with volume and buyer interest.

Image: BTC/USD via TradingView.

Image: BTC/USD via TradingView.

Lack of buyer interest has been an issue at the current prices but with steady price, action volume can also grow over the next few days.

The next resistance is at $38,636 and the price needs to close above that resistance in order to continue this positive rally, the following week should be interesting regardless.

The Relative Strength Index (a popular indicator used by traders to assess the price momentum) continues to be in the oversold position for which is a good indicator of buyer interest.

Historically, after a big drop, the Bitcoin price action becomes very volatile and erratic price action ensues as a result (as market participants remain unsure of plotting their next moves).

Ethereum rides down

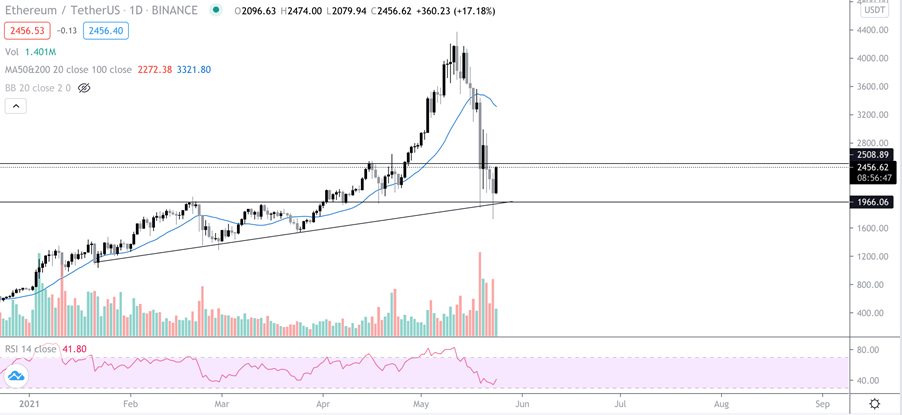

Ethereum also had a massive drop last week along with Bitcoin, but current price action displays a steady recovery. Crucial price levels held well for ETH and the price showed a lot of buyer interest in the sub $2,000 levels.

Image: ETH/USD via TradingView.

Image: ETH/USD via TradingView.

ETH price dipped below $1,900 for the first time since April 2021, but the buyback or buyers interest was substantial in that area and it quickly jumped back up above $2,000. Today, ETH prices saw an upwards bounce as it is up ~26% already.

The next target for the ETH price would be the daily resistance at $2,508. If ETH manages to close above that price during the week we can expect some good gains in the near future for Ethereum.

But similar to Bitcoin, Ethereum needs to take over major resistance levels to get back to its previous upmarket trend.

The post Market Review: Bitcoin, Ethereum markets bounce after a record plunge last week appeared first on CryptoSlate.