Grayscale Investments announced the launch of it’s DeFi Fund for institutional investors in a collaboration with CoinDesk Indexes on July 19. It will allow investors exposure to multiple DeFi heavyweight / blue chip protocols, which might be cumbersome or inconvenient to buy and manage individually. DeFi fund is an index fund featuring a weighted average of top ten DeFi protocols.

Today we’re unveiling Grayscale DeFi Fund, our second diversified investment product, which tracks the @CoinDesk #DeFi Index. Accredited Investors are now able to gain exposure to a selection of industry-leading DeFi protocols through the Fund. Learn more: https://t.co/i0hm9vrklB pic.twitter.com/QASEp9SpfK

— Grayscale (@Grayscale) July 19, 2021

For now, the index composition is as follows:

- Uniswap (UNI), 49.95%

- Aave (AAVE), 10.25%

- Compound (COMP), 8.38%

- Curve (CRV), 7.44%

- MakerDAO (MKR), 6.49%

- SushiSwap (SUSHI), 4.83%

- Synthetix (SNX), 4.43%

- Yearn Finance (YFI), 3.31%

- UMA Protocol (UMA), 2.93%

- Bancor Network Token (BNT), 2.00%

However, subject to quarterly review, it’s likely to change asset/composition wise as the marketcap and other parameters of DeFi protocols fluctuate. This is Grayscale’s fifth investment product and second diversified fund. It’s likely to become a main funnel of institutional money into DeFi protocols, seeing the impact of Grayscale’s other funds for popular cryptocurrencies.

Grayscale DeFi Fund – Official Page

Grayscale DeFi Fund – Official Page

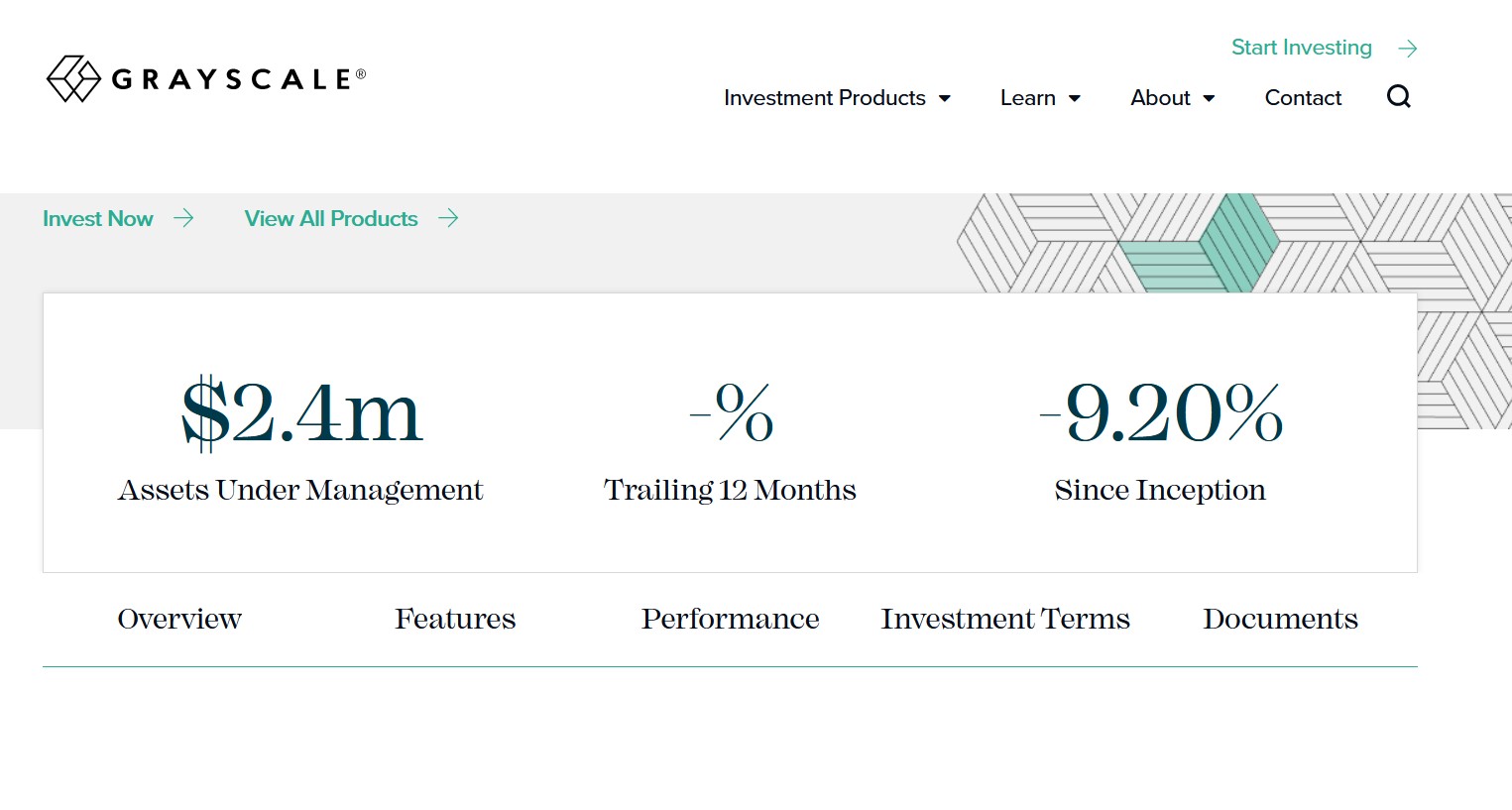

The DeFi fund from Grayscale currently has only $2.4M assets under management (AUM) – a value which is likely rise rapidly as awareness spreads about the potential and benefits of a diversified and methodically defined DeFi protocols index fund, a must for any crypto-investor looking to spread risk and invest in the top DeFi protocols.

About Grayscale Investments

Grayscale Investments is the world’s largest digital currency asset manager. It provides fund management services to accredited investors. The Coinbase custody services are used to handle custody of assets under management (AUM). Grayscale has a variety of products to meet investor’s needs.

They currently offer funds for Bitcoin (BTC), Ether (ETH), Bitcoin Cash (BCH), Ether, Ethereum Classic (ETC), Litecoin (LTC), Horizen (ZEN), Ripple (XRP), Zcash (ZEC), Stellar Lumens (XLM). It remains a vital solution for funds, family offices, investment groups, high and very high net worth individuals, to gain exposure to crypto-assets, without having to worry about the security and custodial issues.

Grayscale DeFi Fund© Cryptoticker

Grayscale DeFi Fund© Cryptoticker

The post Grayscale Launches DeFi Fund For Institutional Investors, What’s Contained? appeared first on CryptoTicker.