Bitcoin finally broke above the $30,000-$34,000 range as it shot up by 15% on Monday. Ethereum also followed Bitcoin with a 12% gain as cryptocurrencies started the week on a high amid rumors of Amazon accepting Bitcoin as a payment option.

Bybt, a popular on-chain data aggregator for cryptocurrencies, reported liquidations of over $1.14 Billion in the past 24 hours.

These massive liquidations were directly related to the sudden jump in Bitcoin price as the majority of the traders were “short” (betting against the uptrend of the market).

IncomeShark, a popular crypto trader, noted that the Bitcoin hashrate (the hashrate indicates the number of times hash values are calculated for PoW every second) was also making a recovery along with the price after the recent ban on Bitcoin mining in China. A higher hashrate is often considered a good sign for the Bitcoin price in general.

$BTC hash rate making a nice recovery. https://t.co/yQCrPAYTLW

— IncomeSharks (@IncomeSharks) July 26, 2021

So what’s next for Bitcoin?

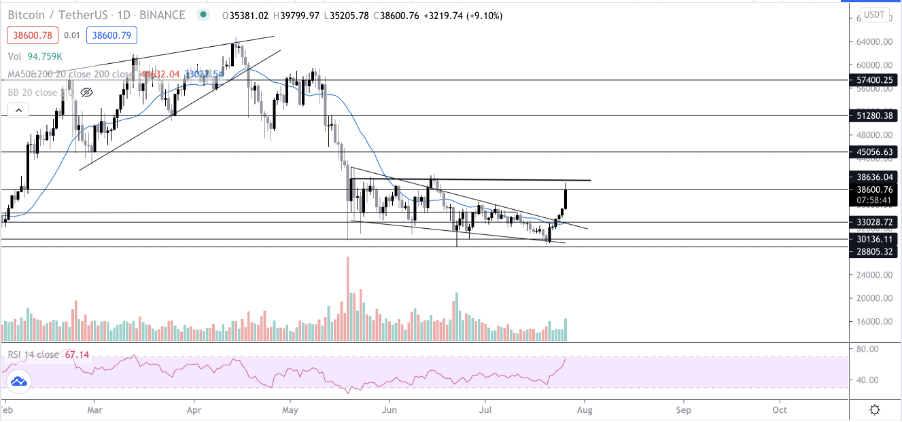

The only bullish scenario played out perfectly as the price broke out of the falling wedge. It can also be noted that there has been a steady rise in the volume which helped the price push upwards.

Image: BTC/USD via TradingView.

Image: BTC/USD via TradingView.

The RSI (relative strength index) Also bounced from the oversold area. After several days of consolation in the $30,000-$34,000 range price finally broke above key resistances.

The next major resistance is at the $38,650 level, meaning in case the price is able to close above that level a continued uptrend can be expected. However, in the past $42,000 has acted as major resistance and it is yet to be seen if the price can go past it considering the current rally.

However, in case of a pullback, the $34,000 price level should act as strong support.

What’s next for Ethereum?

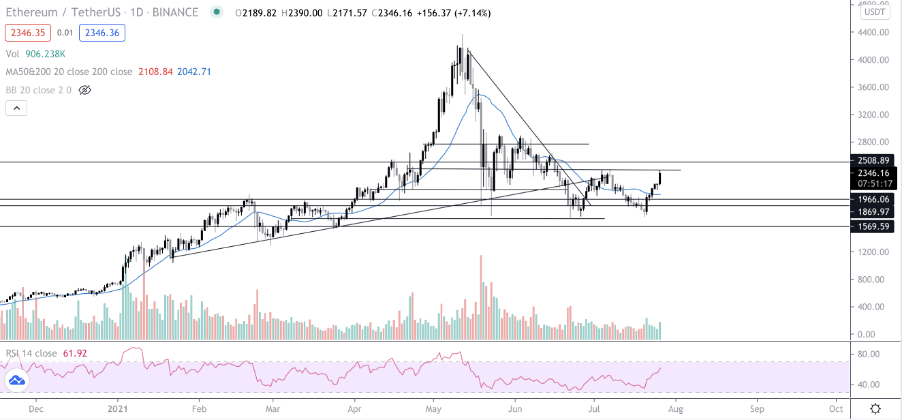

ETH also pushed as bitcoin rallied, however it ran straight into resistance at $2,385. The volume which had been flat recently saw a sudden spike which indicates that buyers are back in control of the price. The RSI, similar to Bitcoin’s, also pushed above from the oversold area.

Image: ETH/USD via TradingView.

Image: ETH/USD via TradingView.

As the above chart shows, ETH price flipped the daily 20MA (indicator traders use to determine market trend using historical movements) and if the price can close above the $2,385 resistance, a continued uptrend towards $2,500 range is very likely for ETH in the coming days.

The post This key resistance level can hinder Bitcoin from reaching ATHs appeared first on CryptoSlate.