The AVAX token has reached a new all-time high after the Avalanche blockchain raised a $230 million investment round led by crypto funds Polychain and Three Arrows Capital. The asset is up by 650% in less than two months.

AVAX Surges to a Fresh ATH

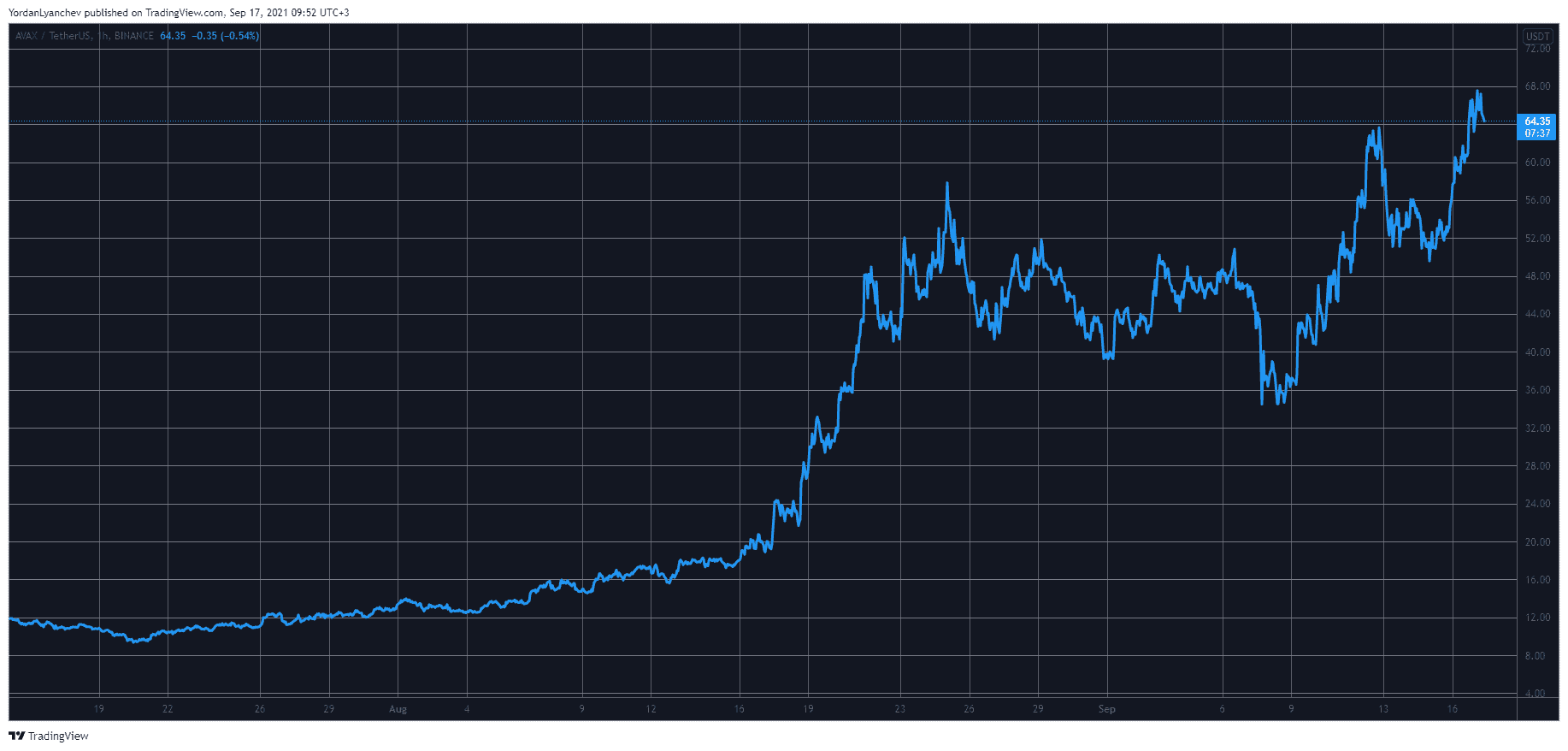

The AVAX token is hot now more than ever, trading at $64 at the time of writing and with a 24-hour trading volume of over $2 million. Even more, it skyrocketed to above $68 hours ago to tap a new all-time high, according to CoinGecko.

AVAXUSD. Source: TradingView

AVAXUSD. Source: TradingView

On a more macro scale, looking from July 20th, the asset has surged by roughly 650% after it had dipped to $9 during that day. The most recent gains came shortly after Avalanche announced the private sale, which was made in June but disclosed today.

The group is conformed by angel investors, family offices, and crypto funds, including Dragonfly, CMS Holdings, Collab+Currency, and Lvna Capital.

BIG News

@Polychaincap and Three Arrows Capital led a $230M investment in the #Avalanche ecosystem to support growth of the platform.https://t.co/T141NFEoIG

— Avalanche

(@avalancheavax) September 16, 2021

As per the blog post, the Avalanche team will use the funds to “support and accelerate the rapid growth of DeFi, enterprise applications, and other use cases on the Avalanche public blockchain.” Avalanche will support projects by including grants, token purchases, and other investments and technology support.

Avalanche Gaining Ground in the DeFi Space

The AVAX token has been up 65% in the past week, outperforming its top 20 competitors in the market. Avalanche, like Solana, is an alternative blockchain in the DeFi space focusing on delivering a high throughput with low gas fees – two problems that PoW (Proof of Work) blockchains like Ethereum have been facing since their creations.

Like Ethereum, Avalanche supports smart contracts, staking, yield farming, users can run dApps (decentralized applications), and more for a lower price. With over 270 projects building on the platform, Avalanche is now one the fastest organic growing blockchains in the market. Some of those projects include Tether, SushiSwap, Chainlink, and more.

Avalanche has quickly turned promise and potential into real-world impact and value creation for DeFi users and developers. The community of builders rallying around the network is a testament to its competitive edge, and there is still so much potential yet to be tapped at the intersection of institutional and decentralized finance on Avalanche.” Said Emin Gün Sirer, director of Avalanche Foundation.

On August 30, OpenOcean – a DeFi and CeFi aggregator – integrated Avalanche to enhance liquidity, as per a Monday press release shared with CryptoPotato.