Mega pools recently launched at Puzzle Swap have already proven the magic of numbers showing incredible APY for liquidity providers averaging at 400% and at times peaking above the 1500% mark. In this article, we will explain how mega pools work and what makes them special.

How is this possible?

Throughout the past week, our team has been getting the same question from the users: how is 1500% APY even possible?

Usually, DeFi services achieve such rates through liquidity mining, which implies issuing a new token and distributing it to investors. In contrast, the Puzzle Swap pool model allows you to have a high yield cap while skipping the infinite token minting. The independence of investors from token price and emission makes it a highly sustainable solution.

So what enables profitability? First of all, commissions. Liquidity providers get rewarded for each transaction and there’s a lot of them. In the first three days of trading, the volume exceeded 500,000 USD, and with average liquidity of $200,000, we can clearly see that the liquidity is overused by 250%.

Such a high volume can be explained by the mathematics behind mega pools, which favors arbitrageurs and traders. Let’s take the following example.

Trader Bob buys token A in a mega pool that also contains tokens B, C, and USD. This transaction changes not only the price of token A but also affects tokens B and C. Thereby, Bob creates a profitable opportunity for another trader.

A single trade can cause 3–5 other trades, which will increase the trading volume and, consequently, the commissions of liquidity providers.

It’s also possible to add that the first pools launched on Puzzle Swap are so profitable due to the initially high yield of the tokens. Most of them have an APY above 100%, which benefits liquidity providers as well as Puzzle Swap because of its monopolistic market position when it comes to trading these tokens.

However, high yield is not the primary benefit of mega pools. There is also a less obvious but integral advantage.

Hidden power of mega pools

What could be more important than a 1500% APY, you may ask? And our answer is investment security. The mega pool model allows you to diversify your portfolio and mitigate its volatility at once.

Thus, by providing liquidity in mega pools on Puzzle Swap, you not only get investment returns but also get a new pool token collateralized by all deposit assets.

There is a similar instrument in traditional finance called index — security with a value based on all underlying assets.

Compared to traditional finance, Puzzle Swap has its advantages here, too! Following the DeFi principles, the price of the mega pool index is determined algorithmically and doesn’t depend on intermediaries who can manipulate it. The value of such an index is based purely on the value of the assets in the pool.

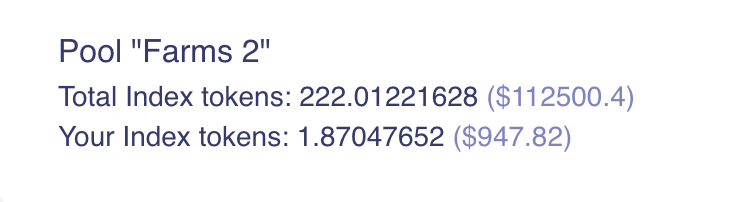

For instance, there are 9 different token types in the Farms 2 pool, with a total value of $112,500. These tokens get converted into 222 index tokens. The account on the screenshot above owns 1.87 index tokens, which is equivalent to $947.

Currently, all index tokens are automatically staked to earn APY in the pool. But imagine if these index tokens could be traded, or just stored in your portfolio — this is where all the fun will start!

It’s staggering to see the first results of liquidity providing launch for the mega pools containing tokens from the Waves Ducks universe. But that is nothing compared to the full capacity of Puzzle Swap.

The formula behind mega pools enabling token indexes has proven to be worthwhile, and it will advance value not only by the means of APY but also by attracting investors interested in low-risk investments.

This is our vision of DeFi 2.0!

Enjoy high profitability and keep up with the updates by subscribing to our Twitter and joining our Telegram chat.

Disclosure: This article was written by PuzzleSwap

The post Explaining the Power of Mega Pools appeared first on The Merkle News.