[PRESS RELEASE – Please Read Disclaimer]

As Bitcoin prices continue to drop and hover around the $47,000 price mark—well below November’s high of nearly $69,000—anxious investors have begun to look for earning opportunities that don’t require major risk. One of those opportunities which have gained popularity among crypto traders is fixed deposits with high annualized percentage yields (APY).

Fixed deposits allow investors to lend their crypto for set periods of time, as short as a week or as long as a month, for example, in exchange for a return amount. The longer the time period, the more reward potential possible. An easy and relatively risk-free way to dive into investing, fixed deposit lending is gaining momentum in the crypto community.

Huobi Prime Earn Introduces Fixed Deposits Products

Huobi Global, the world’s leading digital asset exchange under Huobi Group, first discovered the potential of fixed deposits with the launch of its first Prime Earn event at the end of 2021. With each of the first Prime Earn products selling out within just four days and the total staked amount reaching $132 USD, the exchange saw investors’ enthusiasm for high-interest fixed deposit products.

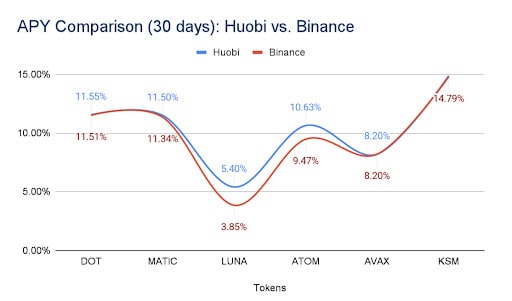

In order to cater to more market needs, Huobi is introducing fixed deposits products for seven popular assets this Wednesday, Jan 5: AXS, DOT, MATIC, LUNA, ATOM, AVAX, and KSM. Among these assets, the 30-day APYs of DOT, ATOM, and KSM are all above 10%, and the 14-day staking APY for AXS is as high as 84%.

“The market fluctuations of the past few months are leading to greater demand for more stable financial products. Currently, most of the digital asset management tools in the crypto space are flexible products with low-interest rates. To address this issue, we’re providing more options for investors to diversify their investment strategies,” said Jeff Mei, Director of Global Strategy.

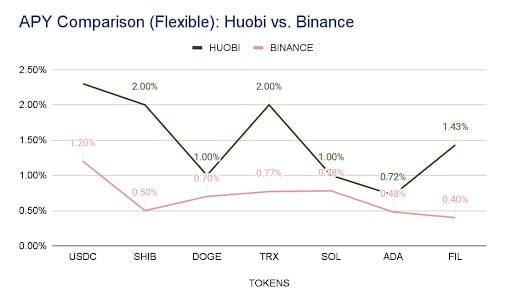

Offering Low-Risk Investing and Token Variety

Huobi Earn is committed to enabling users with lower risk appetites to benefit from the steady appreciation of assets. Along with fixed earning products, Huobi Earn’s high-APY flexible products have also become favorable options among investors. For example, the APY for SHIB at Huobi Earn is 2.00%, in comparison to 0.5% on Binance. For FIL, Huobi Earn offers an APY of 1.43%, nearly four times higher than that of Binance’s product.

Apart from high APY, what separates Huobi Earn from others is the wide variety of assets available for depositing. Huobi offers more than 41 assets for depositing and investment earning opportunities. For investors who want to invest in projects across NFTs, DeFi, GameFi, Huobi also provides fixed, flexible, and featured earning products for these assets.

“Having a variety of token assets, from established and emerging projects alike, gives our users even more investment opportunities in a fluctuating price market,” Mei added.

Huobi Earn is set to launch the second Prime Earn event at the end of January 2022 for investors who want to hold their assets for longer periods of time and earn high APY, so stay tuned for updates. To manage your token assets on Huobi Earn, click here.