With bitcoin’s price continuing to lose value, the popular Fear and Greed Index has dropped into an extreme fear territory once again. In fact, the metric hasn’t been in such a poor state since late January, when the asset’s price dropped to $33,000.

Fear Takes Over

Ever since the end of March, the landscape around the primary cryptocurrency has been rather bearish. Bitcoin was close to $50,000 at that point but failed and started to lose value gradually. In April alone, BTC dumped by more than $10,000 and closed the month below $40,000.

May is not going well either so far. Bitcoin jumped to $40,000 following the latest FOMC meeting, in which the Fed said it will raise interest rates by 50 basis points instead of 75, but that was short-lived.

Soon after, the cryptocurrency plummeted below $36,000, and the situation worsened in the past 24 hours when it dumped to its lowest price point since late January of around $34,000.

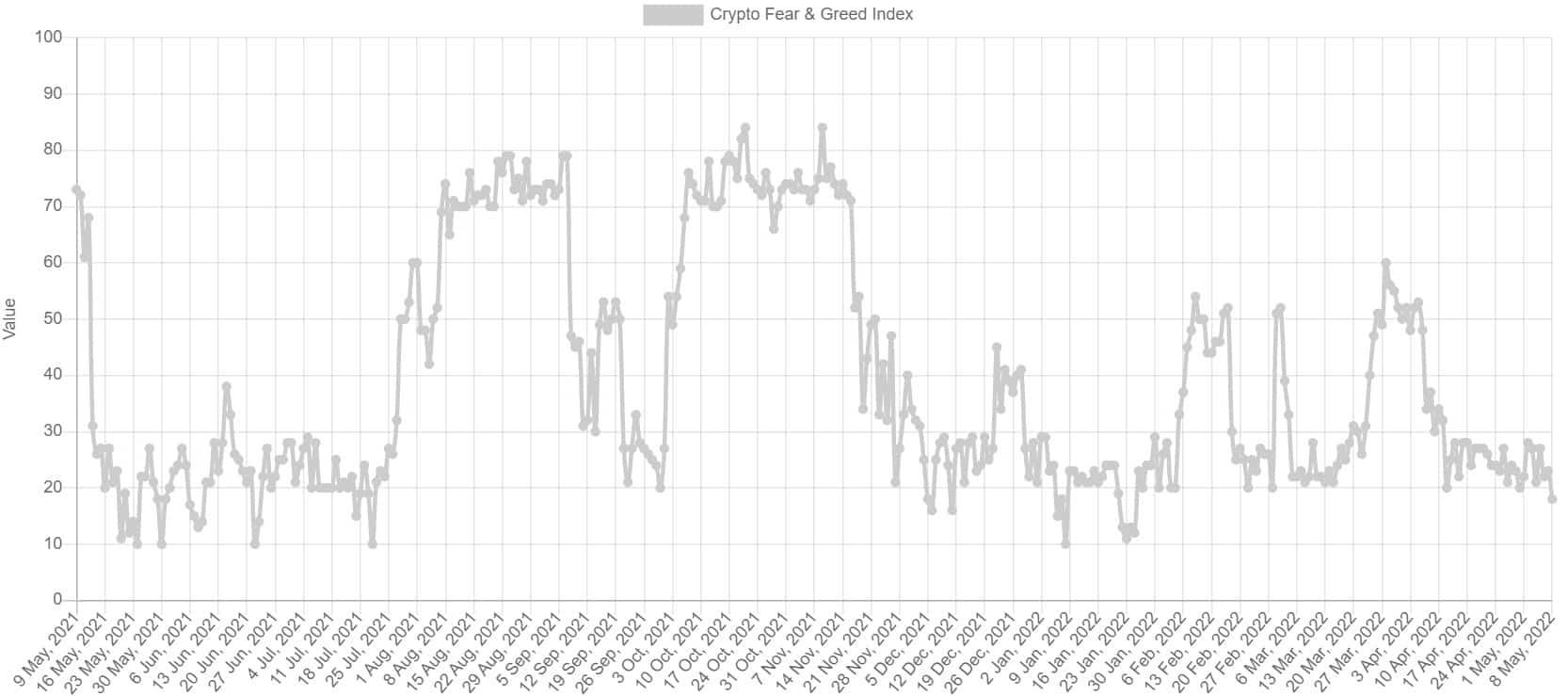

Somewhat expectedly, this violent price crash resulted in a change in the overall market sentiment, shown by the Bitcoin Fear and Green Index. By examining community social media posts, surveys, volatility, trading volume, etc., it determines the general feelings toward the asset. The metric shows the final results from 0 (extreme fear) to 100 (extreme greed).

It has been in a fear territory since mid-April, but the latest price dumps drove it to extreme fear. In fact, by displaying 18 right now, the Index is in its lowest position since the aforementioned late-January drop.

Bitcoin Fear and Greed Index. Source: Alternative.me

Bitcoin Fear and Greed Index. Source: Alternative.me

Whales Behind the Sell-Off?

While retail investors are typically the ones to react more emotionally and dispose of their assets during sell-offs, CryptoQuant data shows a bit of a different story this time.

The analytics resource’s latest research indicates that the number of larger players and whales sending between 10 and 10,000 BTC to exchanges was more significant than smaller investors depositing from 0,01 BTC to 10 BTC.

As such, CryptoQuant concluded that whales could have an “open position on the stock market and realizing profit in crypto could mean reducing risky assets to secure their positions on stocks.”