As we approach bitcoin price all-time highs, we start to see the percentage of circulating supply in profit reach 100%.

The below is from a recent edition of the Deep Dive, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

Supply In Profit

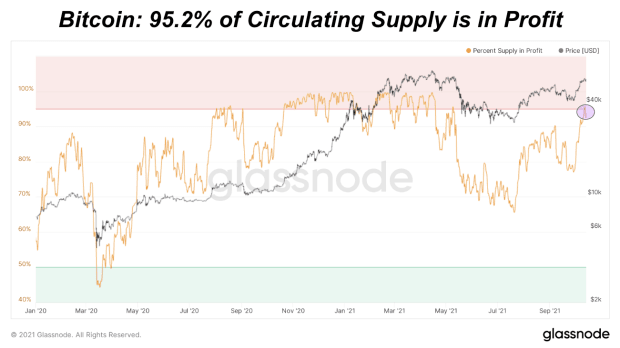

As we approach bitcoin price all-time highs, we will start to see the percentage of circulating supply in profit climb up to 100%. More importantly, we will see long-term holder supply climb to higher profit ranges. Since long-term holders are driving the market with 81% of circulating supply, their profit-taking behavior is key to identifying when the market may cool down as price starts to rip up to new highs. Long-term holders realizing huge profits into previous ATHs signaled the spot market cooling down as derivatives markets took over.

Currently, 95.2% of all bitcoin supply is in profit. During bull cycle top run-ups, supply can exist over 95% in profit for several weeks before healthy drawdowns. Even after these drawdowns, the larger trend can exist for months during bull cycles.

Source: Glasnode

Source: Glasnode

Supply In Loss

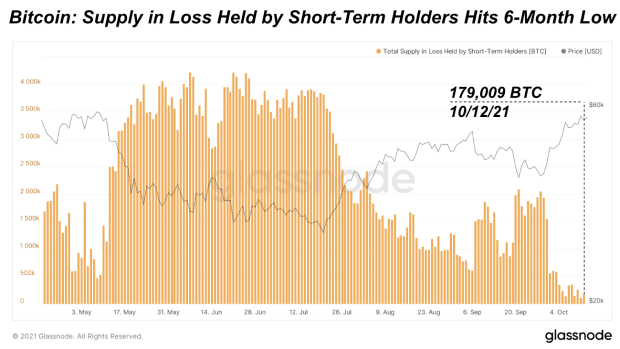

The bitcoin supply in loss has hit a six-month low. This further shows how little stands in the way between new all-time highs; any holder that wishes to exit at breakeven cost will likely have the opportunity over the coming days/weeks ahead.

Source: Glassnode

Source: Glassnode

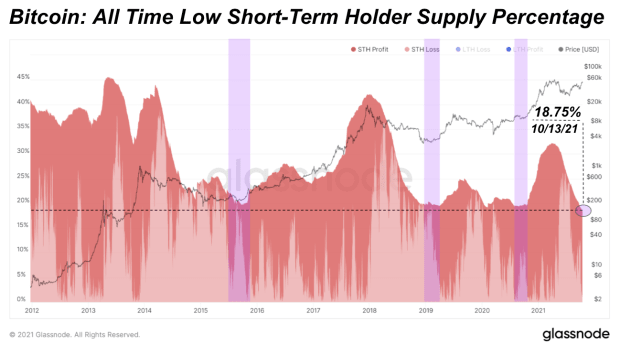

With the feverish increase in holdings by long-term holders since the middle of 2021, the percentage of supply held by said holders continues to break all-time highs.

A different (inverse) look, showing the percentage of short-term holder supply, shows the historic supply squeeze currently taking place. Historically, when short-term holder supply approaches approximately 20%, a bitcoin move upwards is in play. The proverbial spring looks to be as coiled as ever.

Source: Glassnode

Source: Glassnode