- After consolidating above $9,000, bitcoin declined heavily against the US Dollar.

- The price is currently trading in a bearish zone, with a close below $9,000 and $8,920.

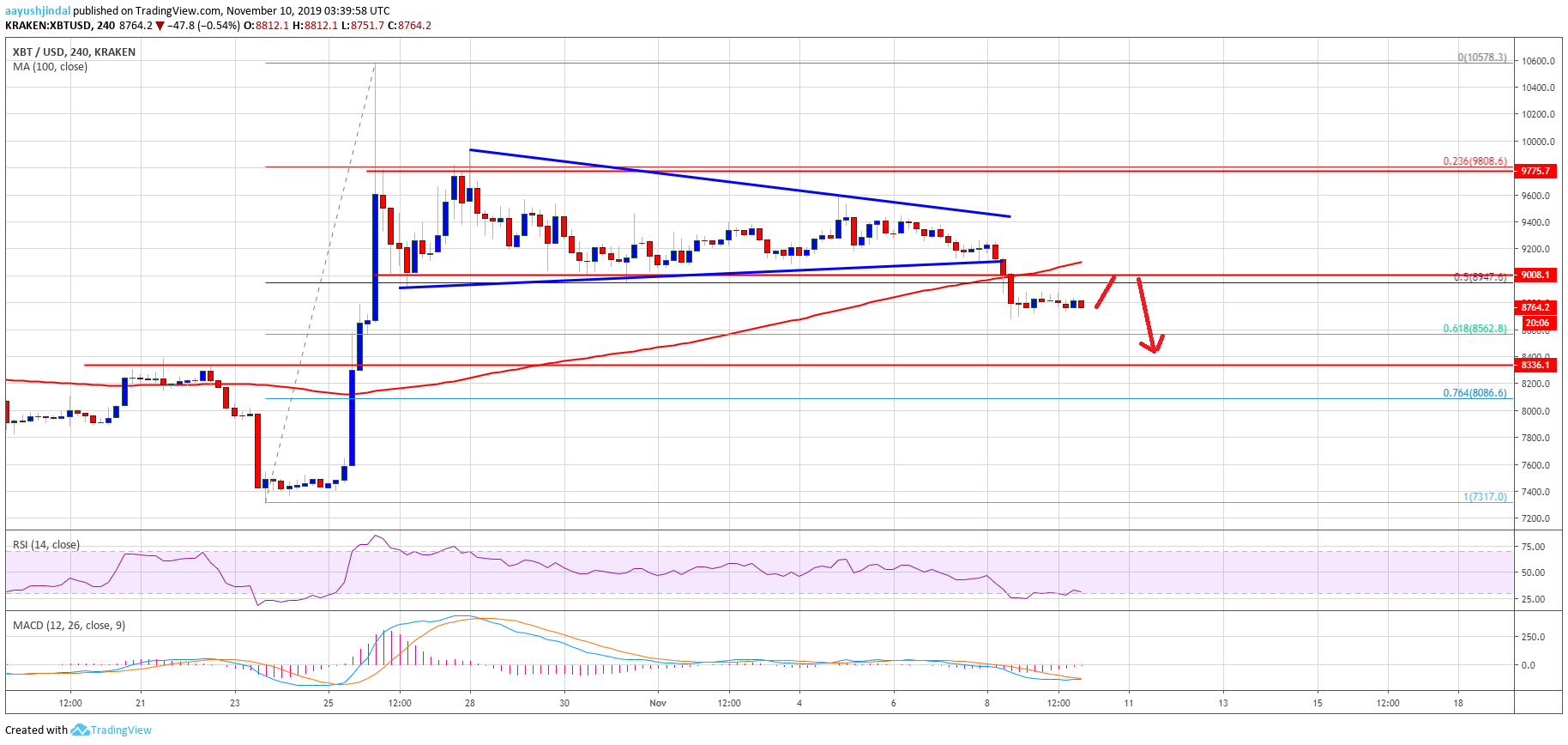

- There was a break below a major contracting triangle with support near $9,180 on the 4-hours chart of the BTC/USD pair (data feed from Kraken).

- The price is currently showing bearish signs and it could decline further towards $8,560 or $8,300.

Bitcoin price is trading in a downtrend below $9,000 against the US Dollar. BTC remains at a risk of more downsides towards $8,300 in the near term.

Bitcoin Price Weekly Analysis (BTC)

In the past few days, bitcoin consolidated in a range above the $9,000 support against the US Dollar. However, the bulls failed to protect losses, resulting in a downside break below the key $9,000 support area.

Additionally, there was a break below the 50% Fib retracement level of the upward move from the $7,317 low to $10,578 high. More importantly, there was a break below a major contracting triangle with support near $9,180 on the 4-hours chart of the BTC/USD pair.

It opened the doors for more losses below the $8,920 support and the 100 simple moving average (4-hours). The decline was strong and bitcoin even settled below the $8,800 level.

At the moment, the price is consolidating below the $9,000 and $8,900 levels. An immediate support is near the $8,600 and $8,560 levels. Moreover, the 61.8% Fib retracement level of the upward move from the $7,317 low to $10,578 high is near the $8,560 level.

If there are more downsides, the price could slide towards the $8,330 and $8,300 support levels. The mentioned $8,300 area acted as a resistance earlier and now it is likely to provide support.

Any further losses may push the price towards the $8,080 support. It represents the 76.4% Fib retracement level of the upward move from the $7,317 low to $10,578 high.

On the upside, the recent support area near the $9,000 level could act as a resistance. Besides, the 100 simple moving average (4-hours) is a major hurdle near the $9,100 level. Therefore, a successful close above $9,100 is needed for more gains in the near term.

Looking at the chart, bitcoin price is clearly trading in a bearish zone below the $9,000 support and the 100 simple moving average (4-hours). Thus, there are high chances of more losses towards the $8,560 support or $8,300 pivot area.

Technical indicators

4 hours MACD – The MACD for BTC/USD is slowly losing pace in the bearish zone.

4 hours RSI (Relative Strength Index) – The RSI for BTC/USD is now well below the 40 level.

Major Support Level – $8,560

Major Resistance Level – $9,100

The post Bitcoin (BTC) Price Weekly Forecast: More Downsides Likely appeared first on NewsBTC.