After several days of adverse price developments, bitcoin has calmed just over the $35,000 price tag. Most alternative coins, though, continue to register price losses, with ETH sliding to $2,200 again and XRP dumping by more than 5% in a day.

Bitcoin Stalls Above $35K

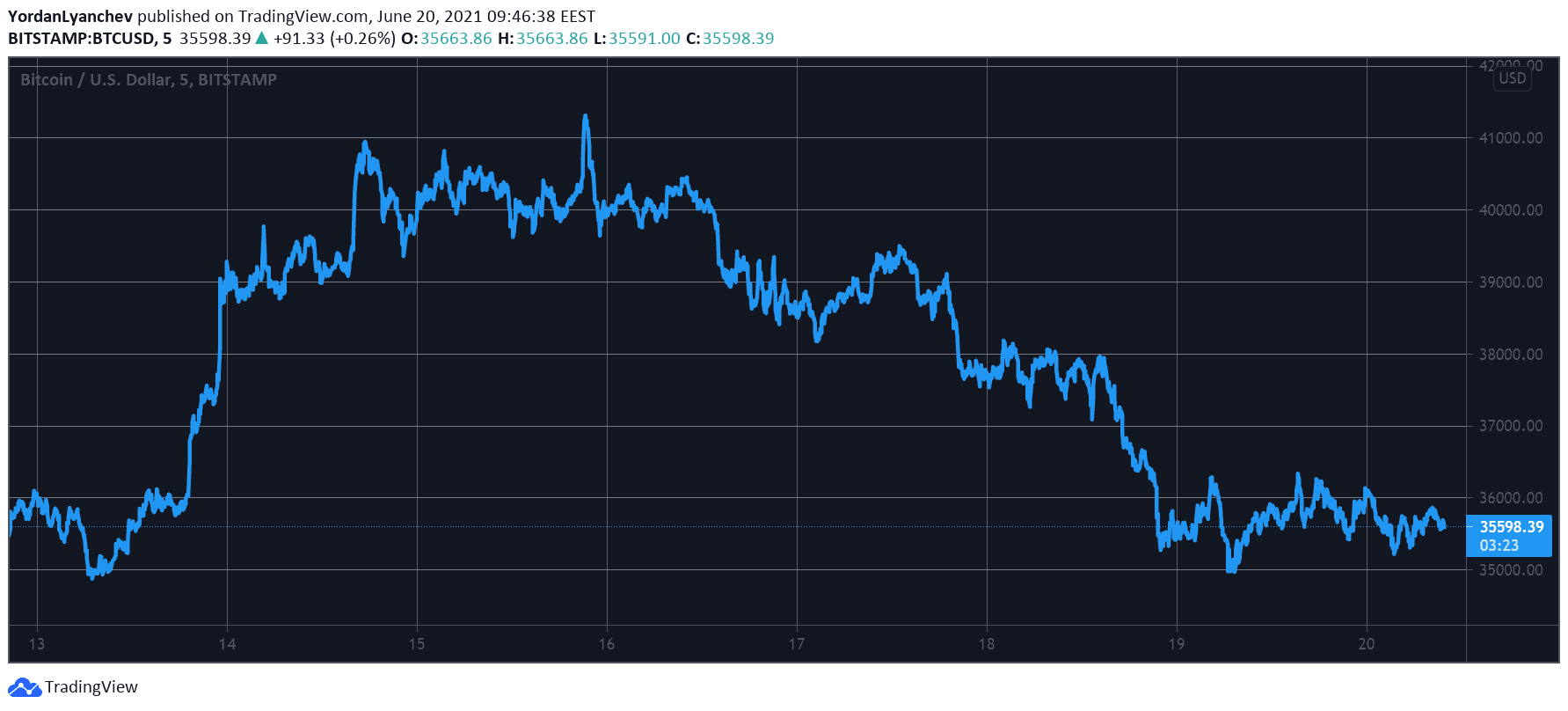

The workweek was going in bitcoin’s way for several days as it had spiked above $40,000 to a new 26-day high at $41,375 on Tuesday. As the community started preparing for another leg up that can take the asset to $50,000, the bears regained control, and BTC began losing value.

In the following days, the cryptocurrency gradually fell below several round-numbered price lines. This resulted in yesterday’s low of beneath $35,000 – meaning that BTC had lost more than $6,000 in a few days.

Since then, the asset has reclaimed some ground and trades several hundred dollars above that line. Although it seems stagnant and calm now, there’s still danger around the corner.

From a technical standpoint, the death cross has just transpired with history suggesting more bearish trading. On the other side, FUD is coming from different places, with a UK bank reportedly planning to cease doing business with two of the industry’s giants – Kraken and Binance.

BTCUSD. Source: TradingView

BTCUSD. Source: TradingView

Altcoins’ Struggles Continue

The alternative coins have performed even worse than BTC in the past several days. Ethereum was riding high until Tuesday to above $2,600. However, it has lost over $400 of value since then and is currently down to around $2,200.

Binance Coin has also lost a substantial chunk of value in days and is now well beneath $340. The situation with the other larger-cap alts is quite similar.

On a 24-hour scale alone, Ripple has dumped by 5% to $0.75. Cardano (-1.5%), Dogecoin (-3%), Polkadot (-4%), Uniswap (-2%), Bitcoin Cash (-2%), and Litecoin (-2.5%) are also in the red.

Cryptocurrency Market Overview. Source: Quantify Crypto

Cryptocurrency Market Overview. Source: Quantify Crypto

Apart from Amp, which has spiked by 20% since yesterday to almost $0.1, most other lower- and mid-cap altcoins have bled out as well.

Quant leads this adverse trend with an 8% decline. Theta Fuel (-7%), Hedera Hashgraph (-7%), THORChain (-6%), Celsius (-5%), and Qtum (-5%) follow suit.

As a result, the market capitalization of all crypto assets has remained below $1.5 trillion.