While a lot of people are uncertain about whether BTC price will reach a new high or strike a new low, there’s a shred of evidence pointing to the highest accumulated number of Bitcoin by investors in recent years, storing cryptocurrency without a visible intention to sell.

Most Bitcoin investors trust the digital asset and hold it passively, refusing to sell despite the solid gains accumulated since their first acquisition. If they were serendipitous, they would have acquired Bitcoins in 2018, when the price wasn’t far away from $3,000 whereas it hit an all-time high of $20,000 in the previous year (2017). Even though Bitcoin recently converged the $10,000 benchmark, it is still far-standing from the ATH record.

Many adherents are hoping that the market will leave them positively surprised. Thus, holders are sticking to their strategies despite visible gains and have a long-term vision of Bitcoin price going up even higher.

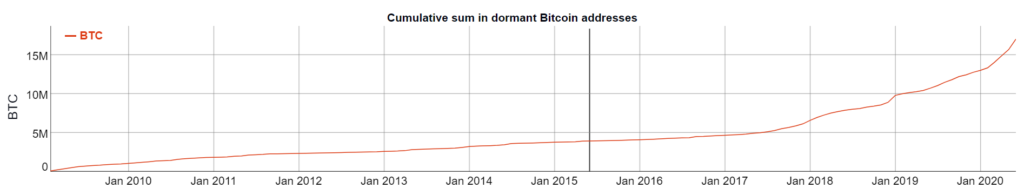

This may explain why the fraction of inactive Bitcoin users is so strikingly high, and collectively reaches up to 60%:

Chart By BitInfoCharts

Chart By BitInfoCharts

To HODL or not to hold?

Even though investors seemed to correlate highly positive expectations in relation to it at the start of the year, later on, it was shrunk by unanticipated behavior. One such example is the March price fall: contrary to common expectations, Bitcoin price went sharply down, while it was expected to do the opposite by many. Since then, Bitcoin has been labeled as a poor option for diversification, especially in the context of the crisis brought by the pandemic.

Bloomberg’s senior editor Joe Weisenthal recently discussed six reasons why 2020 has been a distressing year for bitcoin so far. This narrative was quickly rebuffed by the bitcoin community, highlighting facts why the year has been very good for the digital asset.

6 REASONS IT’S BEEN A BAD YEAR FOR BITCOIN.

In today’s @Markets newsletter, I wrote about all the ways that 2020 has undermined a bunch of popular Bitcoin narratives.

https://t.co/001CaQMvIB— Joe Weisenthal (@TheStalwart)

According to Weisenthal, Bitcoin has failed to conquer new heights, especially in the light of the halving event that took place on May 11. That proved that this major and long-anticipated occasion left with no much change, which left many investors baffled.

Furthermore, the performance of Bitcoin was not that distinct from its peer and close follower, Ethereum. And what is even more surprising, due to extraordinary volatility, this year the stock market’s behavior is not much different from cryptocurrency too. This puts a rivalry between the two, while many people, especially with no former experience in investing, are opting for a more ‘tangible’ stock.