After riding high for a few days, the bitcoin bears have regained control and pushed down the asset by a few thousand dollars to around $35,000. Most alternative coins have suffered even more severely, with ETH down to $2,300 and BNB to $330.

Bitcoin Falls to $35K

Bitcoin performed rather well in the past few days following bullish news from El Salvador, India, and some large corporations wanting to get a piece of the cryptocurrency pie.

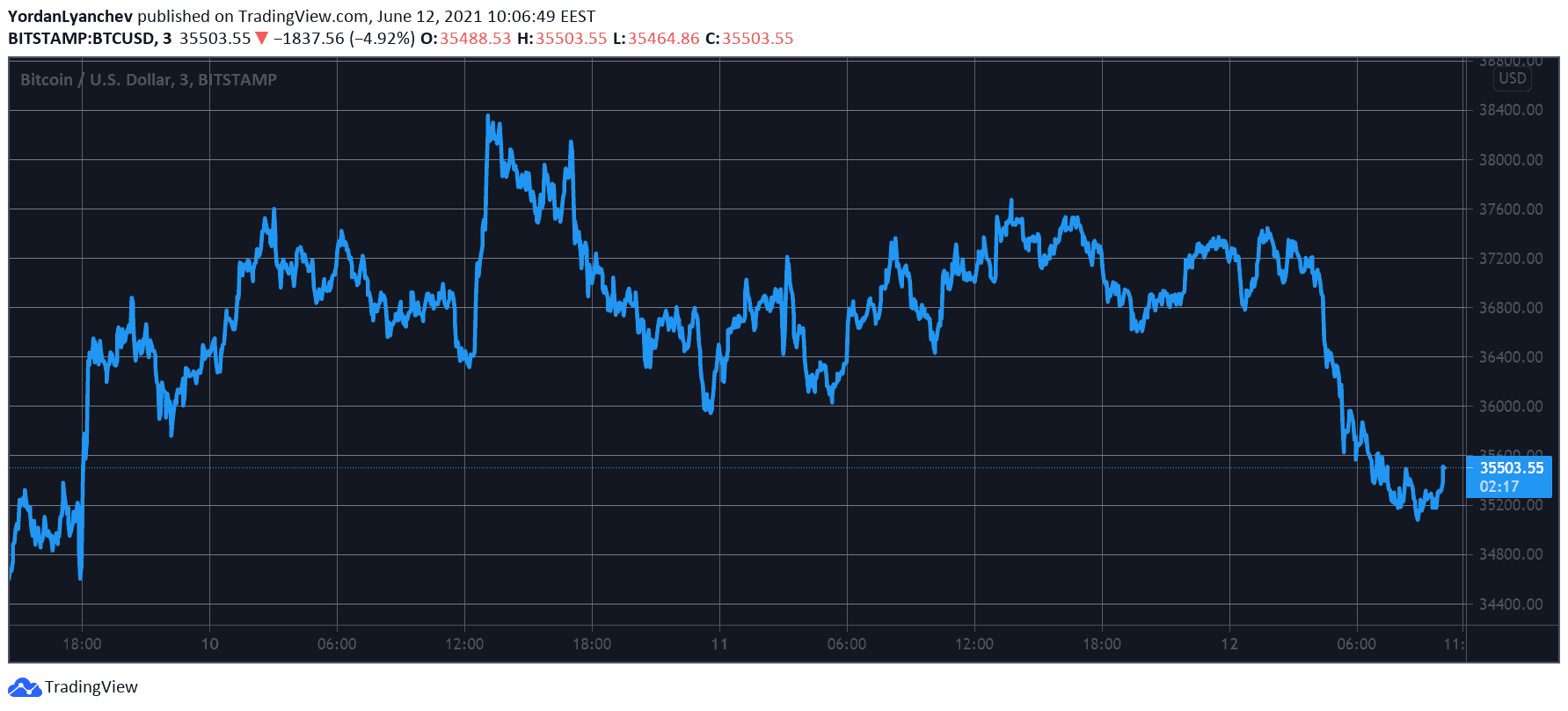

BTC spiked to a six-day high at $38,500 on Thursday but retraced slightly to around $37,000, where it stood yesterday. However, the situation has changed quite vigorously since then.

The primary crypto lost more than $2,000 in hours and briefly dipped beneath $35,000. Despite recovering a few hundred dollars and currently standing above that line, BTC is still 4% down on a 24-hour scale.

Its market capitalization is well beneath $700 billion once more. But on the positive side, bitcoin’s market dominance is above 44%, as the altcoins have plummeted even harder.

BTCUSD. Source: TradingView

BTCUSD. Source: TradingView

Altcoins Covered in Blood

While BTC has lost about 4% of value in a day, most of the altcoin market is even deeper in red. Just a few days ago, Ethereum jumped above $2,600, but it has retraced by around $300 since then to $2,300.

Binance Coin has lost $50 from its mid-week peak when the asset spiked above $380. The latest retracement, though, has driven BNB to around $330.

Cardano (-8.5%) struggles below $1.4. DOGE (-5%), XRP (-5%), BCH (-7%), LTC (-9%), and SOL (-9%) are also deep in red from the larger-cap altcoins.

Polkadot and Uniswap have declined by double-digit percentages. As a result, both are close to dumping below $20.

Cryptocurrency Market Overview. Source: Quantify Crypto

Cryptocurrency Market Overview. Source: Quantify Crypto

The situation with the lower- and mid-cap alternative coins is even worse. THORChain has dropped the most since yesterday, after a 20% decline to $6.5.

Bitcoin Gold (-16%), Kusama (-16%), Siacoin (-15%), SushiSwap (-15%), Amp (-15%), Fantom (-14%), ICP (-12%), Klaytn (-12%), Horizen (-12%), and SHIBA INU (-12%) are just a few more representatives of the double-digit losers club.

Ultimately, the cumulative market capitalization of all cryptocurrency assets has lost $100 billion in a day and $160 billion in two days and is now below $1.5 trillion.