Despite the growing bullish hype and respect for support levels by Bitcoin, controversial Hex founder, Richard Heart believes that an 85% crash by Bitcoin is imminent, and it’s no different from the past.

The controversial founder of Hex in an interview with Kitco News sounded the alarm referencing the 2017 dip that saw Bitcoin plunge by about 83% in a year, which he believes is bound to happen again in the current situation.

“Any time we get one of these big run-ups which by the way is usually followed by a crash, which I think we are due for the rest of the crash, we’re already down half, I think we’ll go down another 75% to an 85% total drop,”.

In his opinion, Bitcoin was bound to hit $10,000 from its high of $65,000 because as he said “that is normally what it does; it drops 85%.” He equally hinted at Ethereum following suit, this time with a 95% drop since the asset has lower liquidity than Bitcoin.

Heart disagreed with suppositions that since institutional traders and big investors investing in the asset would only make the coin less volatile pushing its price higher stressing that his previous predictions were always correct, and so with this one.

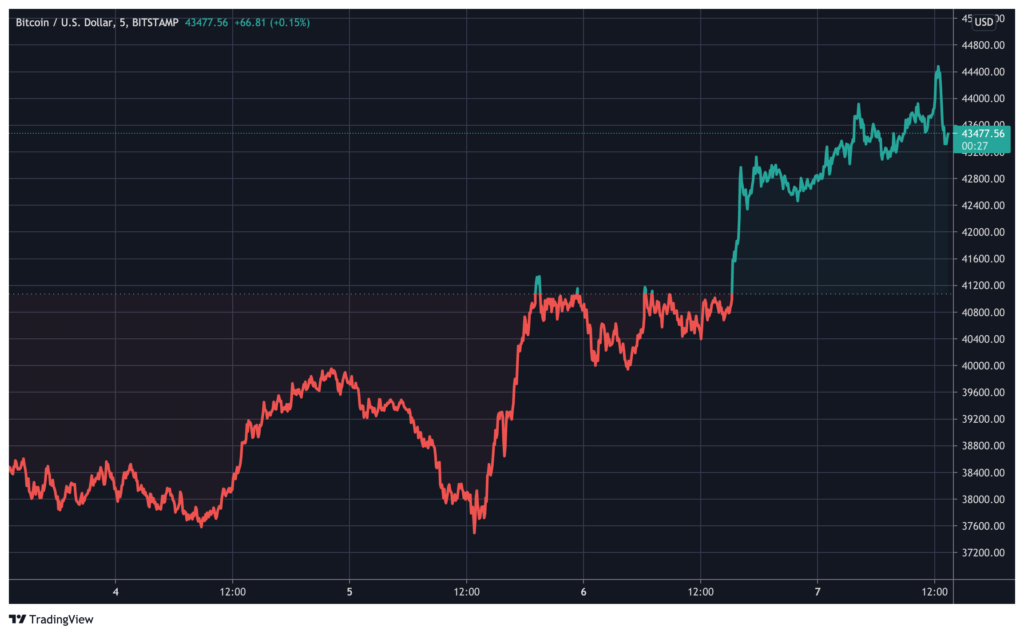

BTCUSD Chart by TradingView

BTCUSD Chart by TradingView

“They’re wrong and I am right. I have a history of calling the top. I called the $65,000 top on the day and drew the chart and then I told you the last cycle ethereum had topped. 27 days later guess what happened. This cycle, exactly 27 days later, Ethereum topped. I got it 100% right you couldn’t possibly do better, and I did the same thing in 2017” he added.

The outspoken crypto pundit also warned against people buying into the “big investor bought” story stating that when news that big investors were buying bitcoin surfaced, it was probably the best time to consider shorting. He also dismissed the narrative that increased mining activity would push the asset’s price higher as “fan fiction theories”, stating that the cost of mining did not hold price up, instead mining price followed Bitcoin’s price.

The HEX founder claimed that he has seen these cycles since bitcoin’s inception and his predictions would come to pass. He joins a list of other crypto analysts and concerned parties who have also made a bet on Bitcoin plunging lower such as Ki-Young Ju, the CEO of on-chain analytics company CryptoQuant who equally predicted an 85% retracement of the assets price in June.

JPMorgan also predicted a drop below $25,000 terming it as fair value for investors. Whereas a lot of predictions on Bitcoin’s price movement seem bullish, price action is telling on many levels, leaving a lot to be desired as to whether Bitcoin could drop lower.

On Saturday, Bitcoin continued to skyrocket in value inside the no-mans-land, with a 6% gain by noon to trade in the $43,000 range. Investors are worried that with the ongoing volatility, a drop below the $29,000 support level could spell an agonizing trickle-down in the price of the asset.