Bitcoin has spiked again towards a new three-week high above $59,600. However, the asset’s inability to breach $60,000 has cost it some of its market dominance.

The metric dropped below 44% as Ethereum, Binance Coin, Cardano, Litecoin, and Chainlink have marked new all-time highs.

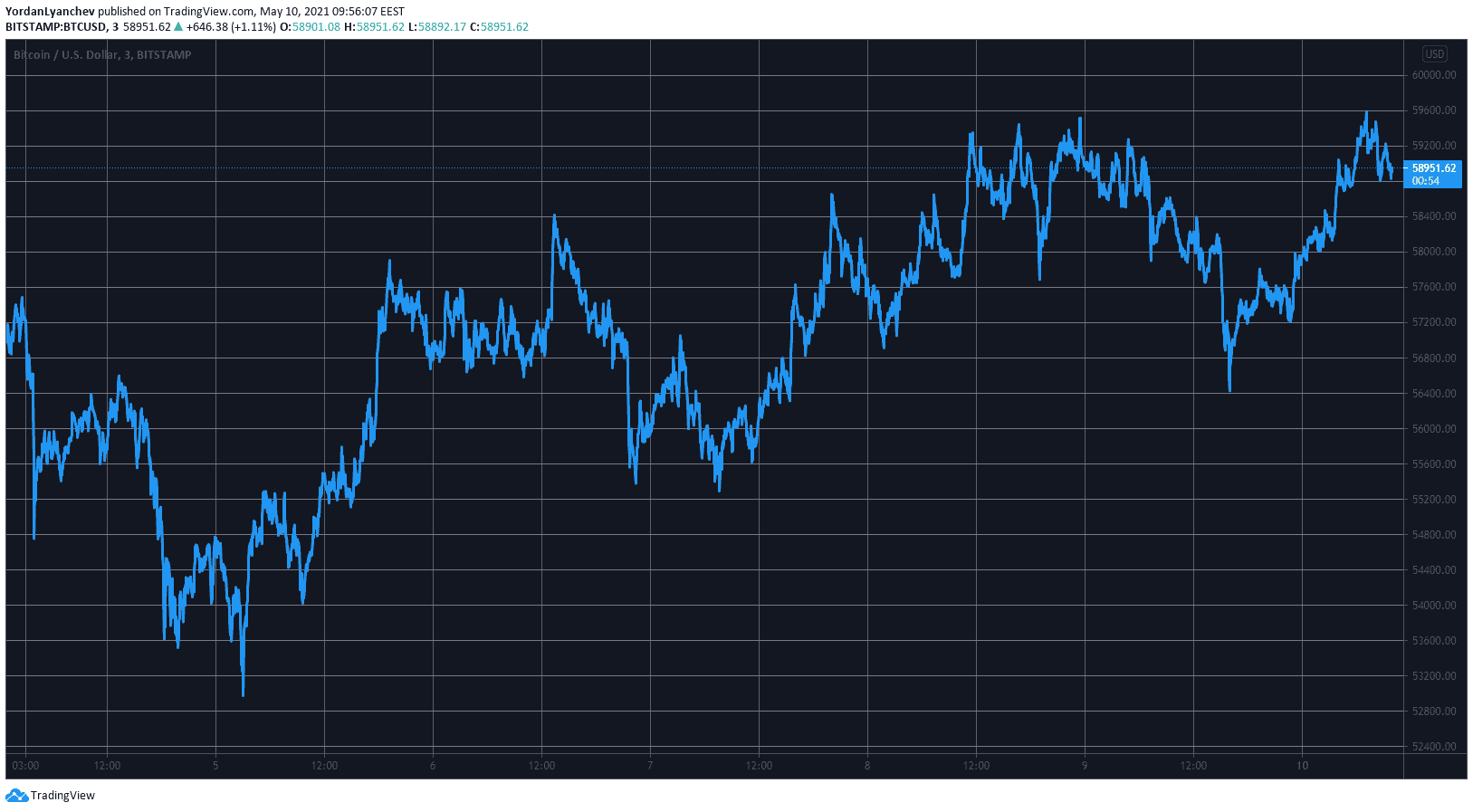

Bitcoin Eyes $60K

After dipping to $55,000 a few days ago, the bitcoin bulls have pushed the asset north. In a matter of 24 hours, the cryptocurrency neared $59,000 and even briefly spiked above it at first.

However, the bears didn’t allow further increases, and BTC even retraced below $56,500 after one of the rejections. Nevertheless, bitcoin recovered just as quickly.

In fact, the asset spiked to a new 3-week high at just over $59,600 a few hours ago. Despite retracing slightly since then, BTC continues to flirt with the $59,000 level.

The developments in the altcoins market are significantly more positive, which has reduced bitcoin’s dominance over the market. The metric measuring BTC’s share relative to that of the entire market is down to a near 3-year low at beneath 44%.

All-Time High Records Across the Alt Chart

As mentioned above, the alternative coins continue to produce impressive results in recent weeks, and quite a few of them have gone for new records in the past 24 hours again.

As reported just hours ago, Ethereum breached $4,000 for the first time. ETH kept going north and marked its latest ATH at $4,150 (on Bitstamp). Binance Coin followed along, and a 6% surge took the token to a record of its own at nearly $690.

Cardano, which has also been increasing for a few consecutive weeks, charted a record above $1.8. Chainlink and Litecoin did the same at above $52 and $400, respectively.

Polkadot (4.5%), Ripple (3.5%), Uniswap (2%), and Bitcoin Cash (11%) are also well in the green.

Cryptocurrency Market Overview. Source: Quantify Crypto

Cryptocurrency Market Overview. Source: Quantify Crypto

More gains are evident from OKB (16%), Telcoin (15%), Huobi Token (15%), Fantom (13%), Lisk (11%), Venus (11%), Harmony (11%), and Stellar (10%).

Ultimately, the cumulative market capitalization of all cryptocurrency assets went for a record at above $2.5 trillion.