Bitcoin has recovered a significant portion of yesterday’s dump after jumping to well above $57,000. Most altcoins have followed suit, including Ethereum, which has surged to yet another ATH.

Green In the Alt Field, ETH’s Latest ATH

As CryptoPotato reported yesterday, red had conquered the entire crypto market, and losses were coming from all directions. The high-flyer Ethereum went from its ATH at the time of $4,200 to below $3,700 in hours.

However, the situation has reversed entirely since then. ETH is a valid example of this after not only recovering all of its losses but emerging higher to its latest record that came just minutes ago at over $4,360. Despite sliding slightly since then, the second-largest crypto is still about 10% up on a 24-hour scale. Another notable achievement is that its market capitalization reached $500 billion for the first time.

Binance Coin also fell hard yesterday but has pumped by 5% to just shy of $680. Ripple (5%), DOGE (34%), Cardano (8%), Polkadot (9%), and Litecoin (6%) are well in the green.

Nevertheless, Bitcoin Cash is the most significant gainer from the top ten after a 15% surge. Consequently, BCH trades well above $1,500.

Cryptocurrency Market Overview. Source: Quantify Crypto

Cryptocurrency Market Overview. Source: Quantify Crypto

Further gains come from EOS (45%), Polygon (40%), Yearn.Finance (37%), SushiSwap (24%), Reavain (20%), Aave (19%), Zcash (18%), OMG Network (17%), Kusama (16%), Waves (17%), and more.

Ultimately, the crypto market cap has added over $250 billion in two days and registered a new record at $2.560 trillion.

Bitcoin Touched $58K

The primary cryptocurrency also felt the negative consequences of the market dump yesterday but similarly to most altcoins has recovered some ground.

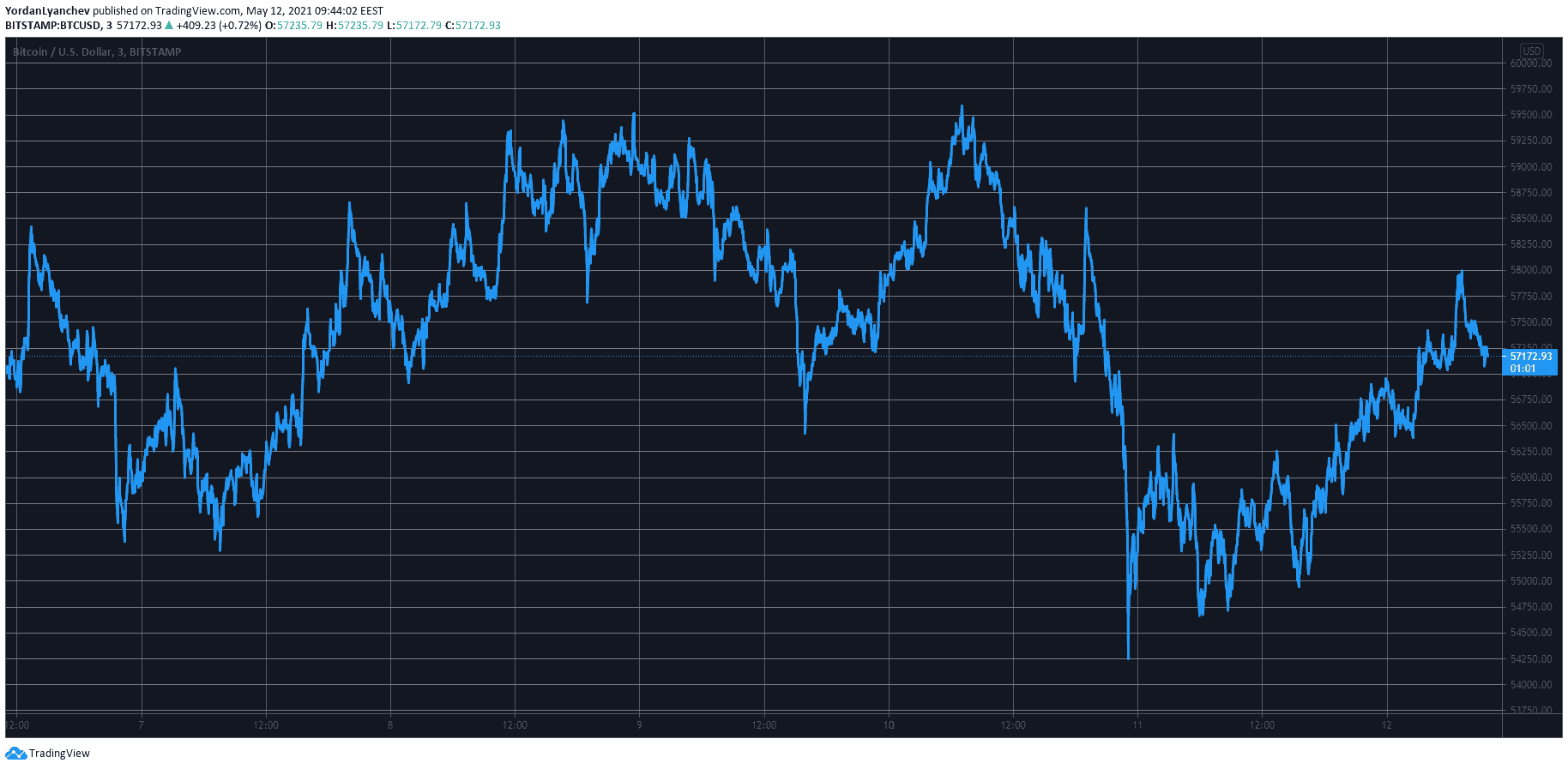

Bitcoin fell from $59,600 to a low of around $54,000 in a matter of hours. Since then, though, the bulls have taken charge and didn’t allow and further declines.

Just the opposite, BTC added around $4,000 of value to an intraday high of around $58,000. The asset has retraced slightly since then but still trades above $57,000.

Its dominance, though, keeps fading and is down to a new near 3-year low at 42.2%. Just for reference, the metric was well above 72% at the start of 2021.