Craig Wright has suffered another loss in court related to debunked claims that he invented Bitcoin, and now he’s been ordered to pay $100 million.

Craig Steven Wright has suffered a massive loss in the almost four-year-old legal dispute with Ira Kleiman, who has claimed that his deceased brother, David Kleiman, was entitled to 1.1 million bitcoin that Wright seized from him following a business partnership.

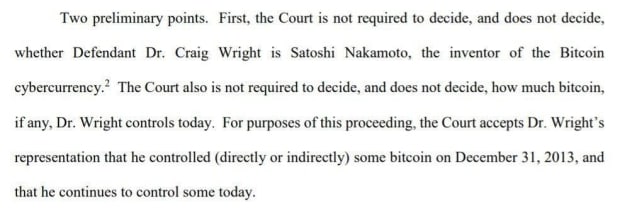

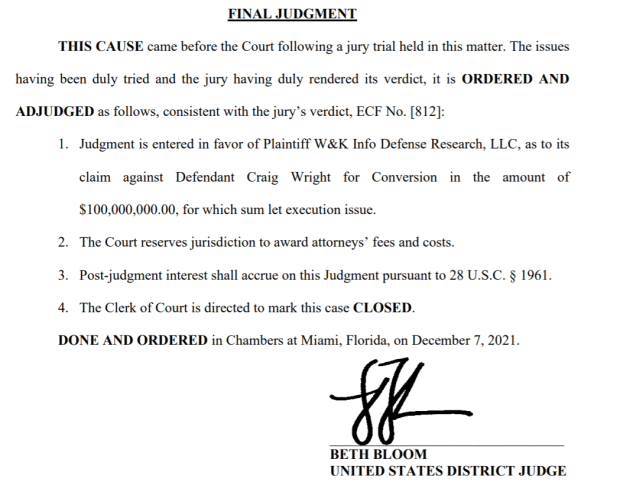

The Australian-born Wright — who is currently living in the U.K. after fleeing his home country during the heat of Australian Taxation Office (ATO) raids in December 2015, as reported by the London Review Of Books — must pay $100 million as ordered by U.S. District Judge Beth Bloom, though the court did not make a ruling on whether or not Wright is the real identity behind Bitcoin’s pseudonymous creator Satoshi Nakamoto. The judge issued an Allen charge, as the jurors could not agree on a verdict, before it found Wright liable on one of the claims.

The time has finally come, after almost four years of litigation and a 15-day trial, we have a ruling in the Kleiman versus Wright lawsuit. And it was a resounding verdict.

Source: United States District Court Southern District Of Florida, “Final Judgement”

Source: United States District Court Southern District Of Florida, “Final Judgement”

Wright, after having faced intermediate rulings by Magistrate Judge Bruce E. Reinhart and Judge Bloom for “willful and bad faith pattern of obstructive behavior, including submitting incomplete or deceptive pleadings, filing a false declaration, knowingly producing a fraudulent trust document, and giving perjurious testimony at the evidentiary hearing,” as the order on the plaintiffs’ motion put it, and the like, is now ordered to pay no less than $100 million to W&K Info Defense Research LLC (W&K) after the jury found him “liable for conversion,” as Fortune reported.

“One Of The Top Ten Verdicts” In The U.S. This Year

According to well-known American cryptocurrency lawyer Stephen Palley, partner at Anderson Kill, $100 million is “Probably one of the top ten verdicts in the US this year.”

W&K was only one of two plaintiffs in the lawsuit. The other plaintiff is Ira Kleiman himself, who is, as said, the brother of the late Dave Kleiman, who was also the sole member of the company that he founded with Wright and his ex-wife Lynn Wright in 2011.

Now, let’s make one thing perfectly clear from the get go: this lawsuit was never about determining if Wright, or anyone else for that matter, was possibly Nakamoto, nor about issuing a ruling about such a fact. However, there is a firm case to be made that the jury, during its deliberations to come to a verdict about these accusations, rejected this claim that has been made by Wright. More about that later.

Jury’s Deliberations

The interesting thing is that the jury’s verdict does not contain an explanation of how this verdict for “conversion” was reached. Let’s note first that the dispute between Ira Kleiman and Wright started with several accusations, according to an opinion from 2020, including:

- Breach of partnership

- Breach of fiduciary duty

- Fraud

- Constructive fraud

- Civil theft

- Unjust enrichment

- Conversion

So, why was conversion the only one on the list that Wright was found liable for?

After having been following the entire lawsuit from almost the beginning, and the trial from day-to-day through local court reporter Carolina Bolado and several other public reporters, it strongly appears to me that the Jury has chosen the following line of thought during their deliberations.

For starters, there were no award for breach of partnership or breach of fiduciary duty, suggesting that the jury was not convinced by claims in which Wright represented himself to be Nakamoto, having had a partnership with Dave Kleiman that led to the creation and launch of Bitcoin. This is crucial to understand from the start.

To explain why, let’s have a look at the facts of this matter. Only a few pieces of presumed evidence of Wright’s Satoshi-ness were provided during trial to support this misrepresentation, and they were nowhere near convincing.

For example, the jury was treated with a (highly-anticipated and broadly-discussed outside of the court) handwritten note including the minutes from a meeting between Wright and accounting firm BDO, his former employer, in which Wright described the future roll-out of an electronic cash system, as CoinGeek reported.

However, such a handwritten note is not compelling evidence to me. Coming from Wright, who has a well-documented history of Nakamoto-related counterfeits, several of which were presented and thoroughly debunked during trial, per an export report from Dr. Matthew J. Edman. In fact, since Wright has been building on his Nakamoto fantasies over the years, it can be said with confidence that the meeting note were probably written sometime in the years from 2014 to 2021. In any case, we can assume that this kind of “evidence” was not very convincing to the jury.

Wright’s Counsel

Wright’s own lawyers have also contributed, knowingly or unknowingly, to the thorough destruction of Wright’s false representation to be Satoshi Nakamoto.

During their closing arguments, just before the jury deliberations started, they performed a classic “Chewbacca defense” — a legal strategy that sees the defense attempt to confuse the jury, as opposed to directly refuting the claims brought against it. According to Bitcoin-focused visual artist Fractal Encrypt, who tweeted quotes from the last day of the trial, Wright’s defense team made statements like, “…So we have this heaping, stinking pile of forgeries, and this is what the plaintiffs are basing their case on? Their case is that CSW is a liar and a forger … but I’m going to use another word: ‘Fantasist.’”

Now, let’s bring back in memory that Wright’s statement, made as recently as August 30, 2018 (which is six months after the Kleiman versus Wright lawsuit started), was this:

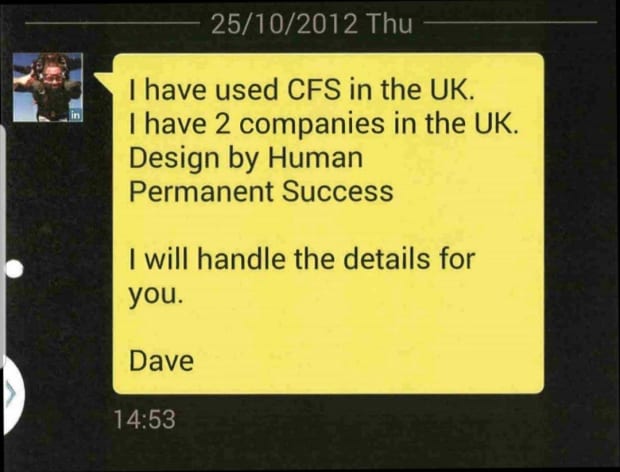

Source: A now-deleted WeChat conversation in which Wright participated. Link unavailable.

Source: A now-deleted WeChat conversation in which Wright participated. Link unavailable.

Now, imagine that Ira Kleiman’s counsel relentlessly defended its position with handfuls of examples in which Wright, and only Wright or sources quoting Wright, declared on numerous occasions that he had worked together or partnered with Dave Kleiman to create and launch Bitcoin.

And now imagine the effects of Wright’s counsel’s Chewbacca defense.

The Chewbacca defense likely once again would draw the jury’s attention to the undeniable fact that, indeed, Ira Kleiman’s apparent support of Wright’s false Nakamoto narrative and Wright’s made up Dave/Craig Bitcoin partnership are both based on a stinking pile of forgeries, to which the jury should have had full access during deliberations — dubious digital documents; emails; PGP key use cases; blog posts; contracts; chat room conversations; screenshots; several documents that were said to be forgeries by Edman during the trial; damning ATO reports that took down several aspects of Wright’s Satoshi claims as a “nullity based on sham” (including the alleged David Rees cooperation on Wright’s claimed Satoshi team), as well as many unreliable and conflicting witness statements that made no sense.

So, there’s little doubt that the hilarious Chewbacca defense from Wright’s attorney had the jury thinking, and thinking again after the Allen charge once they got stuck.

In this scenario, it is difficult to see Wright’s false Satoshi claims as separate from this narrative of Dave/Craig working together on the launch of Bitcoin. And, as a result, the defense counsel got exactly what it asked for: an invalidation of both “breach” charges.

One of many examples of Wright’s forgeries, which popped up in the Kleiman versus Wright case. Wright ostensibly bought these two shell companies in January 2014 from CFS. Source: Court Listener.

One of many examples of Wright’s forgeries, which popped up in the Kleiman versus Wright case. Wright ostensibly bought these two shell companies in January 2014 from CFS. Source: Court Listener.

Fraud Or No Fraud?

Why did the jury fail to find Wright liable for the “fraud” or “constructive fraud” charges?

In my opinion, and please allow discussion to begin about this stance, when the jury deliberated about these two accusations, it likely determined that the actual fraud — of the criminal kind — was largely aimed at the ATO in the years 2013 to 2015, and as such, there was not so much civil fraud against Ira Kleiman and/or Dave Kleiman’s company, W&K.

And, again, Kleiman versus Wright was a civil lawsuit. Therefore, it will be left to the ATO, which has been conducting a criminal investigation into Wright since at least 2018, according to another filing in Kleiman versus Wright, to tackle the criminal fraud that Wright allegedly performed. At the moment, it appears that in the U.S., this case is closed.

And unless Judge Bloom decides in the coming weeks that an additional criminal prosecution should be filed against Wright, where we could possibly determine if my analysis about fraud makes any sense, we might never find out what the deliberations were about the fraud accusations. On the other hand, I do not consider the chance of further action from Judge Bloom to be that substantial, to be honest. But, who knows?

The fact is, the jury did not find Wright liable for penalties for fraud or constructive fraud.

Conversion

That leaves the last three accusations on the list included above, “civil theft,” “unjust enrichment” and “conversion.” Of those three theft-related allegations, conversion was likely chosen by the jury because it comes closest to what was really going on in the case. To understand this properly, we have to take a deep dive into the lawsuit. Buckle up, and follow me for a little rollercoaster ride through the 2011 to 2013 era.

If we reconstruct the storyline established in the plaintiff filing, in early 2011, Wright and Kleiman had tried, under the W&K label, to land four IT/cybersecurity-related projects from the U.S. Department of Homeland Security (DHS). However, their four proposals were kindly but firmly rejected by DHS. After that, the two men didn’t perform any business activities anymore under the W&K label, and as a result, W&K was struck from the local registry in 2012 when Dave Kleiman, the sole member of W&K, didn’t pay for the renewal of the registration.

Again, based on the plaintiff filing, in the second half of 2013, Wright started to completely rewrite the history of W&K using backdated documents, supported by a completely different story than what actually had happened in 2011, the four rejected DHS project numbers were used in a completely made up mix of Bitcoin-related business elements (and some gold was also thrown in, funnily enough), and now W&K in 2011 had suddenly turned from an IT/cybersecurity company that had not done any business, into a company holding Bitcoin IP in 2013! This starts to smell like, as the jury very likely concluded, illegal “conversion.”

Per the filing, in 2013 and early 2014, during and after Wright’s likely illegal conversion, W&K was still registered in the U.S. as a dissolved company, which led to an extremely embarrassing moment for Wright with the ATO later in 2014, when the latter told him that W&K was not really an active company at all. Wright then apparently felt compelled to urgently deploy a certain individual called Uyen Nguyen to reactivate W&K on his behalf. This course of events did, of course, not go unnoticed by the ATO, and it ended up on the long, long list of questionable and fraudulent case descriptions in the many ATO reports.

More about these ATO reports can be found in my article series “Faketoshi, The Early Years,” written together with the well-known scam researcher “CryptoDevil.”

Once again reconstructing the storyline based on the plaintiffs’ filing, this dubious conversion in 2011 of an IT/cybersecurity-related company into a Bitcoin-related company in 2013 allowed Wright to start reclaiming the Bitcoin intellectual property -— again, IP which didn’t exist at all in 2011 — in a fraudulent double-claim lawsuit against W&K towards the end of 2013. And this trick worked, because W&K, which by then was dissolved with its only member Dave Kleiman being dead since April 2013, was not able to be represented during the lawsuits.

Instead, it was Wright himself who sat down at the defense site, roleplayed on paper by his ex-employee and CFO Jamie Wilson. To no one’s surprise, I’m sure, Wilson had no idea that this would happen after he had suddenly left Wright’s startup, Hotwire, the month before, per Wilson’s deposition. The reason for his sudden leave: serious suspicions that Wright was committing fraud.

Nevertheless, this bag of tricks worked out well for Wright initially, and he fraudulently obtained an Australian court’s stamp of approval, and the joint IT/cybersecurity IP of Dave Kleiman and Wright from 2011 was now effectively converted into Bitcoin-related IP that Craig Wright held in 2013. And Wright benefited financially, or tried to at least, from this illegal conversion, as he used the falsely obtained (but paper only) Bitcoin IP to advance his Australian tax fraud further in late 2013, 2014 and 2015.

To conclude, this summarizes the illegal “conversion” that has now been confirmed by the jury in Miami with a whopping $100 million penalty.

The $1 Trillion Claim

But still, a reward of $100 million may not be as big of a win for Ira Kleiman as it sounds, given that nearly $1 trillion was demanded during the trial that lasted more than four weeks, if we may believe court reporter Carolina Bolado. On November 23, 2021, she reported on Twitter:

Source: Twitter

Source: Twitter

The strategy in many civil lawsuits is, of course, to successfully land as many accusations and charges as possible, in addition to coming up with every reason to demand the highest possible financial satisfaction — and with an individual on the defense side impersonating Satoshi Nakamoto — who is estimated to have mined around one million bitcoin (with a current market value of around $50 billion) in Bitcoin’s early days, an would own billions of dollars’ worth of intellectual property — this amount of money may seem like a reasonable sum to collect.

For example, there is the anecdote that Wright, just before the start of the jury trial, claimed in a Slack chatroom that the IP amount at stake in the Kleiman verus Wright lawsuit would be a stunning $252 billion, and evidence of this statement was, of course, immediately brought into trial by Ira Kleiman’s lawyers, per Bolado.

Now, as you prepare for such a civil lawsuit, all that is left is to defend each and every accusation as best as you can to figure out what might stick with the judges and jury.

But, because the Kleiman versus Wright lawsuit was largely built on the quicksand of Wright falsely claiming to be Nakamoto and the nonsensical story of a collaboration with Dave Kleiman to develop Bitcoin, there was not much left in the end as this house of cards collapsed in front of the eyes of the Miami jury during its truth-finding process of deliberations.

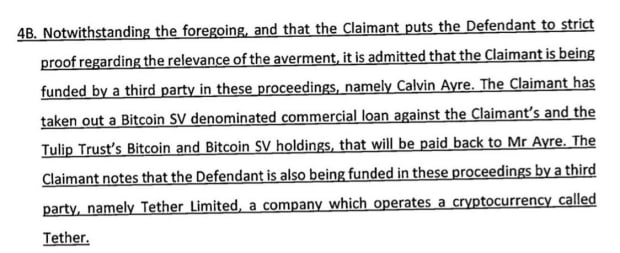

“The Claimant has taken out a Bitcoin SV denominated commercial loan against the Claimant’s and the Tulip Trust’s Bitcoin and Bitcoin SV holdings, that will be paid back to Mr Ayre.” Source: another of Wright’s lawsuits, in which he is the claimant.

“The Claimant has taken out a Bitcoin SV denominated commercial loan against the Claimant’s and the Tulip Trust’s Bitcoin and Bitcoin SV holdings, that will be paid back to Mr Ayre.” Source: another of Wright’s lawsuits, in which he is the claimant.

Let’s not forget, though: $100 million is a debt that Wright is probably not able to pay. After being completely financially ruined in 2015, with millions in ATO claims and fines to pay, then being bailed out by Robert McGregor and Stefan Matthews (with Calvin Ayre in the background), Wright has likely not been able to financially recover in the years since, particularly with his non-existent Tulip Trust.

Non-existent? Yes, non-existent. More on that in a bit. And yes, we do call that a “Nigerian prince advance fee scam.”

Long story short, Wright probably has little to no money of his own, and apparently a lot of debt. And now $100 million has been added.

Misleading Press Coverage

Because not everyone understands the background and the finesses of the Kleiman versus Wright lawsuit, a lawsuit surrounding a fantasist who is impersonating Nakamoto and who many believe has falsely claimed for many years that he had partnered with Dave Kleiman in creating Bitcoin, there are several laughable headlines to be found online.

Headlines like the ones found at Fox Business: “Man Who Claims He Invested Bitcoin Wins Trial, Keeps Bitcoins Worth $50B”, or as found at the website of The Australian: “Court Decides Australian Is Bitcoin Creator.”

Sources: The Australian and Fox Business

Sources: The Australian and Fox Business

It is clear that some media outlets didn’t understand the plaintiffs’ accusations that were actually ruled upon, and the explicit exclusion of a Satoshi determination from the rulings. And what to say about the $50 billion in bitcoin that Wright can “keep”? What you don’t have in the first place, you can’t keep in the second place, right?

Hilarious.

Miami Fun Facts

To conclude this article, let’s go through a few fun facts from this now, assuming no party in the case is going to appeal, closed lawsuit.

Firstly, the $100 million fine isn’t the only monetary penalty that Wright faces. At the beginning of 2020, he also had to pay a fine for obstruction of the judicial procedure of $165,800.09.

Secondly, if Wright doesn’t pay the $100,000,000 now ordered from him, there’s an interest rate ticker that is increasing his debt with nearly $800 every day. The “Debt Clock” can be followed on this page, part of a website that contains comprehensive information about Wright’s lawsuits, leading views on Wright’s claims and more.

Thirdly, we will continue to enjoy, in current and future lawsuits where Wright is a party on either side, the many interim rulings of Judge Reinhart and Judge Bloom and, I expect, some cringeworthy moments for Wright, especially from this damning ruling:

“The totality of the evidence in the record does not substantiate that the Tulip Trust exists,” according to the order on the plaintiffs’ motion in Kleiman versus Wright.

How did this ruling come about? During discovery in the Kleiman versus Wright case, it had been found by Judge Reinhart that Wright had perjured himself regarding the Tulip Trust, and had only provided fraudulent documents and other falsified material about this same trust where Wright claimed his Bitcoin and other Bitcoin-related assets were “locked.”

Judge Reinhart showed no mercy after these findings: there was no trust at all, there were no encrypted files at all and there was no mined or bought bitcoin in the trust, nothing. No trust, no trust assets, which, of course, only adds to the rightful conclusion that Wright is not Nakamoto.

Lastly, during the Miami trial, I (@MyLegacyKit) received a humbling “thank you” on Twitter from Vel Freedman, the head of Ira Kleiman’s legal team.

Source: Twitter

Source: Twitter

This is a guest post by Arthur van Pelt. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine. The writer is not a licensed, practicing attorney and this opinion is not intended as a professional legal analysis, assertion or recommendation.