Digital currency markets have been consolidating since Thursday’s massive price drop after more than $90 billion was erased from the cryptoconomy. Crypto markets saw some brief gains on Friday but prices have been meandering just above current support levels. At the moment, traders and crypto proponents face uncertainty amidst the ongoing coronavirus scare and economic fallout.

Also read: The 35 Most Influential Bitcoiners Dominating Crypto Twitter by Follower Count

Crypto Markets Consolidate at Support Levels

Cryptocurrency prices have seen better days as BTC was over $9,100 per coin seven days ago. On March 12, otherwise known as ‘Black Thursday,’ BTC dropped from the day’s $7,648 high to a low of $3,870 per coin. The swift downfall shook investors to the core, but soon after BTC jumped back above the $5K region and it’s been hovering above this price zone ever since. The cryptoconomy was just over $245 billion on March 1, 2020. All 5,000+ coins in existence have lost roughly $90 billion since then.

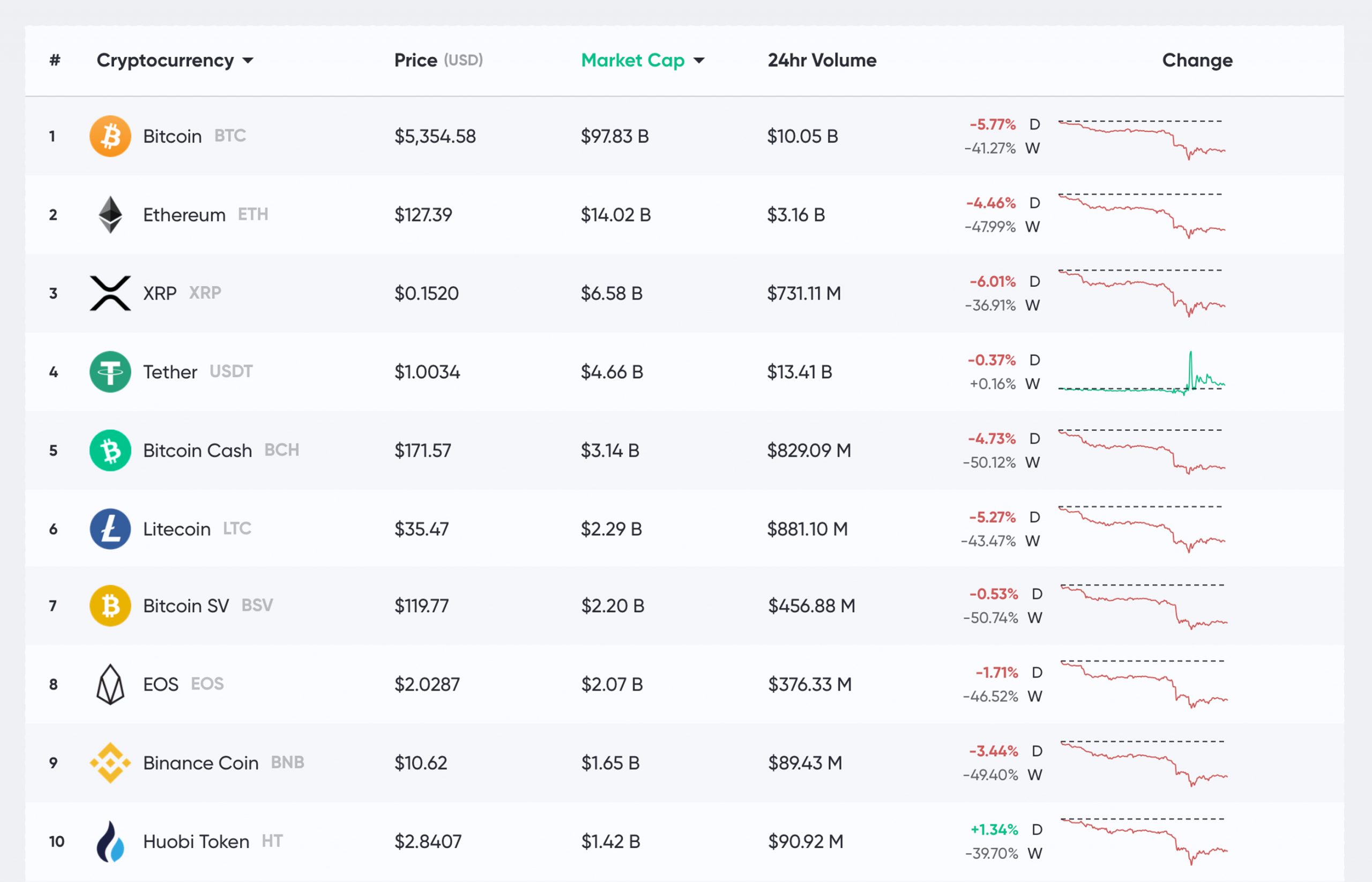

At the time of publication on March 14, BTC is trading at $5,354 but prices have been between the $5,000 to $5,700 range during the last 24 hours. BTC is down 5.7% in the last 24 hours and 41% for the last seven days. Reported trade volume for BTC today is $10 billion, but Messari.io’s “real volume” stats show $2.4 billion. Lots of BTC traders are hedging with stablecoins like tether (USDT) which captures 75% of today’s BTC trades. The USDC stablecoin commands 1.56% of BTC trades and PAX has around 1% as well. This is probably the first time ever that USDC and PAX have been a top-five trading pair with BTC.

Top 10 cryptocurrency market caps on March 14, 2020.

Top 10 cryptocurrency market caps on March 14, 2020.

Following BTC is ethereum (ETH) which is trading for $127. The price per ETH is down 4.4% today and down 47.9% for the week. Reported volume for ETH is around $3.1 billion but “real trade” volume on Saturday is about $659 million according to Messari.io. XRP captures the third-largest market cap today and each XRP is swapping for $0.15 per coin. XRP lost 6% in the last 24 hours and 36% for the last seven days of trading. The stablecoin tether (USDT) holds fourth position on March 14 and the coin is swapping with more than two-thirds of the entire cryptoconomy.

BTC/USD market on March 14, 2020.

BTC/USD market on March 14, 2020.

Bitcoin Cash (BCH/USD) Market Action

Bitcoin cash (BCH) holds the fifth position today after being knocked out of fourth spot by tether (USDT). BCH is down 4.7% on Saturday and the coin lost over 50% during the course of the last week. The top trading pair with bitcoin cash on March 14 is tether (USDT) which commands more than 65% of BCH trades. This is followed by BCH trading pairs like BTC (19%), USD (10%), KRW (2.3%), and ETH (1.3%). At the time of publication, bitcoin cash (BCH) is swapping for $171 per coin.

BCH/USD market on March 14, 2020.

BCH/USD market on March 14, 2020.

Charts show BCH is holding the consolidation period after support was broken on March 12. BCH is still up 16.3% for the last 12 months, but most of the yearly gains are gone. During the last 90 days against the USD, BCH is down 17% and against BTC the price is down 14%.

Over $100 Million in Margin Calls

While crypto markets lost more than $80 billion, news.Bitcoin.com reported that more than $2.2 billion was liquidated from traders on Bitmex, Okex, Huobi, Binance, and FTX. Additionally, according to a report written by Nathan DiCamillo, the firm Genesis Capital called for $100 million in collateral from about 40 different customers. During the last two years, cryptocurrency lending solutions have been extremely popular.

Blockfi had to make some margin calls and reports say Genesis Capital called for $100 million in collateral from about 40 different customers

Blockfi had to make some margin calls and reports say Genesis Capital called for $100 million in collateral from about 40 different customers

The recent market carnage has caused other margin calls from firms like Blockfi as well. “With downward price movement, portions of our USD loan book experience margin calls (and liquidations, in some cases),” Blockfi’s CEO Zac Prince wrote on Thursday. “Issuing a margin call or selling a client’s assets is never something that we want to do and our system is designed with both our clients’ interests and Blockfi’s risk management top of mind.”

Miner Dumps Coin from 2010 Just Before Market Slide

Crypto observers have noticed 1,000 BTC that was mined on August 24, 2010 was recently sent to a Coinbase wallet on March 10. Earlier in the day, a user named ‘whoamisoon’ posted a thread to bitcointalk.org claiming to be the owner of the coins. The individual said he used to mine BTC for a hobby and found out he had 1,000 coins sitting on an old USB drive.

He asked the forum visitors about how he could sell the BTC and obtain his BCH from the address as well. “I mined some bitcoin for a little bit, a long time ago; back when it was still possible to mine with GPU — I haven’t been active here for a long time,” the person wrote. The crypto community has been discussing the alleged sale on forums and social media and they believe he obtained at least $7-8K for the coins or roughly $8 million.

Derivatives Market Open Interest Dives

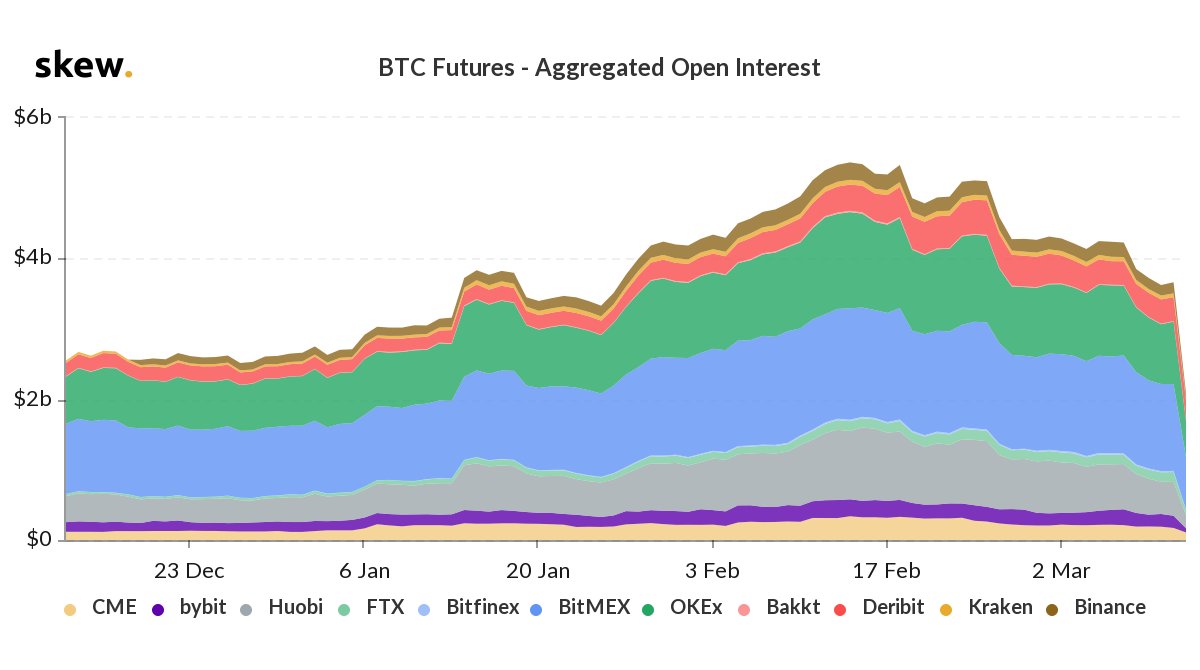

On March 13, crypto derivatives analytics provider Skew.com reported on the market carnage that took place on Thursday. “Bitcoin finally caught up with Wall Street crashing 39% yesterday during one of the most memorable and hectic trading session in its young history,” Skew tweeted. “Nearly $50 billion bitcoin futures were traded across crypto exchanges with two exchanges – OKEx & BitMEX – > $10 billion and eight > $1 billion. Total open interest – the number of outstanding futures positions opened at the close – collapsed nearly 50% to $2 billion,” the analyst added.

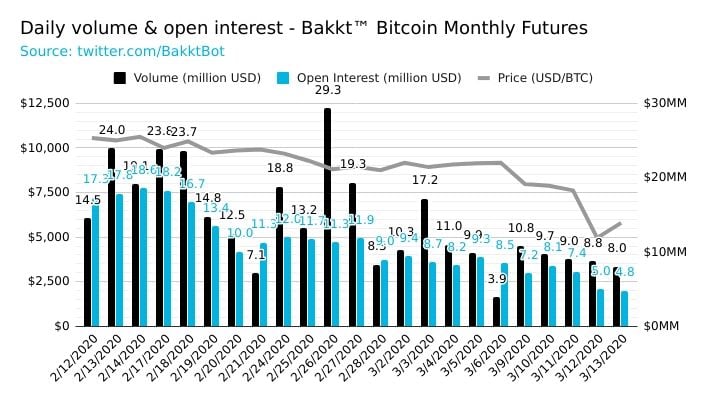

Data stemming from the Bakkt Volume Bot shows that open interest declined significantly as well. An announcement from CME Group made a few people believe that the derivatives giant ceased trading BTC futures but this was not the case. CME simply closed the old school “Chicago trading floor” due to the spread of the coronavirus. Bitcoin futures and options continued but open interest in these products dropped significantly.

All Eyes on the Hashrate and Halvings

Crypto proponents and traders haven’t seen prices this low since March 2019 and a good number of individuals thought the cryptoconomy was about to see another bull run. Now supporters are focused on the hashrate and thinking about the halvings coming up.

SHA256 miner profits with an electricity cost of $0.12 per kWh recorded on March 14, 2020, at 11 a.m. EST. Block rewards will be slashed in half for BTC, BCH, and BSV miners during each network’s halving.

SHA256 miner profits with an electricity cost of $0.12 per kWh recorded on March 14, 2020, at 11 a.m. EST. Block rewards will be slashed in half for BTC, BCH, and BSV miners during each network’s halving.

If crypto prices drop lower or even remain where they are today then big mining operations might have a hard time holding onto profits. BTC’s hashrate has dipped a hair but remains above 100 exahash (EH/s).

Where do you see the cryptocurrency markets heading from here? Let us know what you think about this subject in the comments section below.

Disclaimer: Price articles and market updates are intended for informational purposes only and should not be considered as trading advice. Neither Bitcoin.com nor the author is responsible for any losses or gains, as the ultimate decision to conduct a trade is made by the reader. Always remember that only those in possession of the private keys are in control of the “money.” Cryptocurrency prices referenced in this article were recorded on Saturday, March 14, 2020, at 11:30 a.m. EST.

Images via Shutterstock, Trading View, Bitcoin.com Markets, Twitter, Skew analytics, Fair Use, Pixabay, Bakkt Volume Bot, and Wiki Commons.

Want to create your own secure cold storage paper wallet? Check our tools section. You can also enjoy the easiest way to buy Bitcoin online with us. Download your free Bitcoin wallet and head to our Purchase Bitcoin page where you can buy BCH and BTC securely.

The post Market Update: Cryptocurrency Market Cap Sheds $90B, Margin Calls Spike, Futures Slide appeared first on Bitcoin News.