As the cryptocurrency industry progresses to mainstream adoption, investors seek to understand more about this rapidly growing industry and how they can increase their exposure to it.

On Monday, Nov. 1, 2021, the American multinational investment bank Morgan Stanley published a report on cryptocurrencies for its wealth management clients.

Incoming Regulations

In the document, strategists at Morgan Stanley Research gave a detailed analysis of the various activities, sectors, and trends that currently make up the highly speculative crypto industry.

Earlier in September, the Wall Street giant launched its crypto research division that is focused on analyzing the impact of digital assets on equities and several treasury bonds, led by Sheena Shah.

Morgan Stanley Cryptocurrency Report

Morgan Stanley Cryptocurrency Report

The report pointed out that the increased visibility of the crypto industry in recent months has greatly influenced governments and financial regulators to start looking into ways to introduce regulatory clarity into the space.

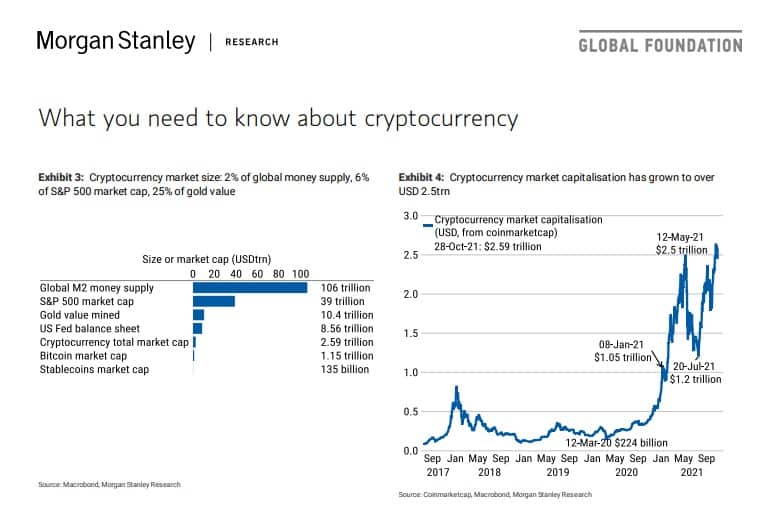

With the entire market currently sitting above $2.5 trillion and the increasing interest in DeFi, NFTs, and stablecoins, Morgan Stanley is convinced that more institutional investors will join the space, speeding up plans for regulation.

Crypto Exposure for Wealth Clients

Meanwhile, earlier in March, Morgan Stanley launched access to three Bitcoin Funds that were targeted at exposing its wealthy clients to the leading digital asset.

The bank had stipulated several requirements needed for clients to participate in the new offering, including a minimum deposit of $5 million and $2 million for institutional and individual investors, respectively.

Morgan Stanley has also not held back from increasing its exposure to Bitcoin. Just last month, the bank purchased more than 58,000 shares in the world’s largest Bitcoin Fund, GBTC.

Institutional Investors Embrace Crypto

With the recent rally in prices, more institutional investors are trooping into the crypto space, with several financial services providers increasing their clients’ exposure to the asset class.

Many of these institutional investors place their bets on the king coin, bitcoin, investing huge sums of money in the cryptocurrency, which is widely considered to be a safe haven asset.