Bitcoin mining, long known as an obscure activity limited to cyberpunks and dominated by Chinese brands, can now be an alternative investment option for accredited investors looking to take a BTC bet.

Do you mine?

Bitfury, an Amsterdam-based Bitcoin mining operator, has launched its ambitious institutional investor program, allowing high-net-worth individuals and deep-pocketed corporations to gain exposure to Bitcoin via owning mining infrastructure.

Participants in the program will invest, via a legal vehicle, in the mining infrastructure and data centers that power Bitcoin farms in Canada, Iceland, Norway, and Central Asia, among others.

The firm announced all internationally accredited investors can join the program, detailing several benefits Bitfury offers over existing options.

Bitfury touts its access to low-cost data centers, electricity, and long-standing expertise in Bitcoin mining as some points that will attract investors. Sure enough, the company’s been around since 2011, making it one of the earliest, if not the earliest, commercial players in Bitcoin mining.

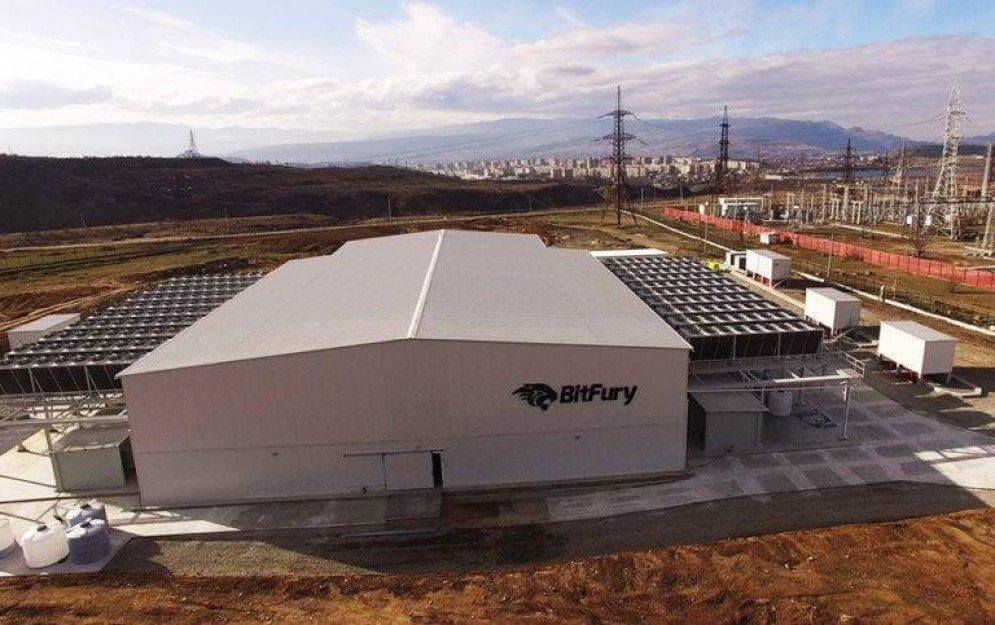

(A Bitfury mining farm. Source: iTech)

(A Bitfury mining farm. Source: iTech)

All operations will be managed by Bitfury, with the firm noting investors can track their financial progress and profitability “at any time online.”

With the launch, the program is one of the first to offer investment in, and subsequently profit from, mining protocols that power the Bitcoin network. Most institutional investors, such as Paul Tudor Jones, depend on purchasing BTC futures, swaps, or options either as a market hedge or long-term investment.

However, the above means taking a directional bet on Bitcoin, which remains a volatile market and is susceptible to massive plunges over a few hours. Security issues, such as wallet hacks or mismanaging private keys, are other limiting concerns.

Overcoming BTC obstacles

Bitfury CEO Valery Vavilov told Forbes the product helps institutional players “overcome” obstacles that traditional routes of Bitcoin investing present, with family offices standing to benefit greatly. He explains:

“Our streamlined avenue to diversification is designed specifically for their portfolios – exposure to digital assets without any of the operational/technical requirements of holding the digital assets/infrastructure themselves.”

Vavilov believes the recent institutional interest in Bitcoin and cryptocurrencies, and the presence of newer products like his firm’s, help propel Bitcoin to “great prestige among former skeptics.”

He notes investors were previously “locked out” of invest at scale, citing extensive set-up costs and operational expertise, alongside holding large amounts of Bitcoin.

“The introduction of institutional offerings like Bitfury’s program introduces bitcoin to an influential audience, helping solidify it as an asset class and shoring up support for the network’s continued expansion,” he concluded.

The post Move over BTC futures, the world’s accredited millionaires can now profit by mining Bitcoin appeared first on CryptoSlate.