Ethereum has been steadily gaining 5% a day over the last week and is now reaching a new high of $2900. Ethereum is currently trading at a new all-time high of $2866, with a market capitalization of $331 billion.

New Month, New ATH

For the first time in history, Ethereum was able to reach $2,850, and it is on its way to surpassing $3,000. This will help the virtual currency to break its all-time high price and get closer to Bitcoin’s market capitalization. While Bitcoin remains the most common virtual currency, its market share has fallen below 49%, and Ethereum’s market share is approaching 15%.

ETH/USD pair break above $2,850. Source: TradingView

ETH/USD pair break above $2,850. Source: TradingView

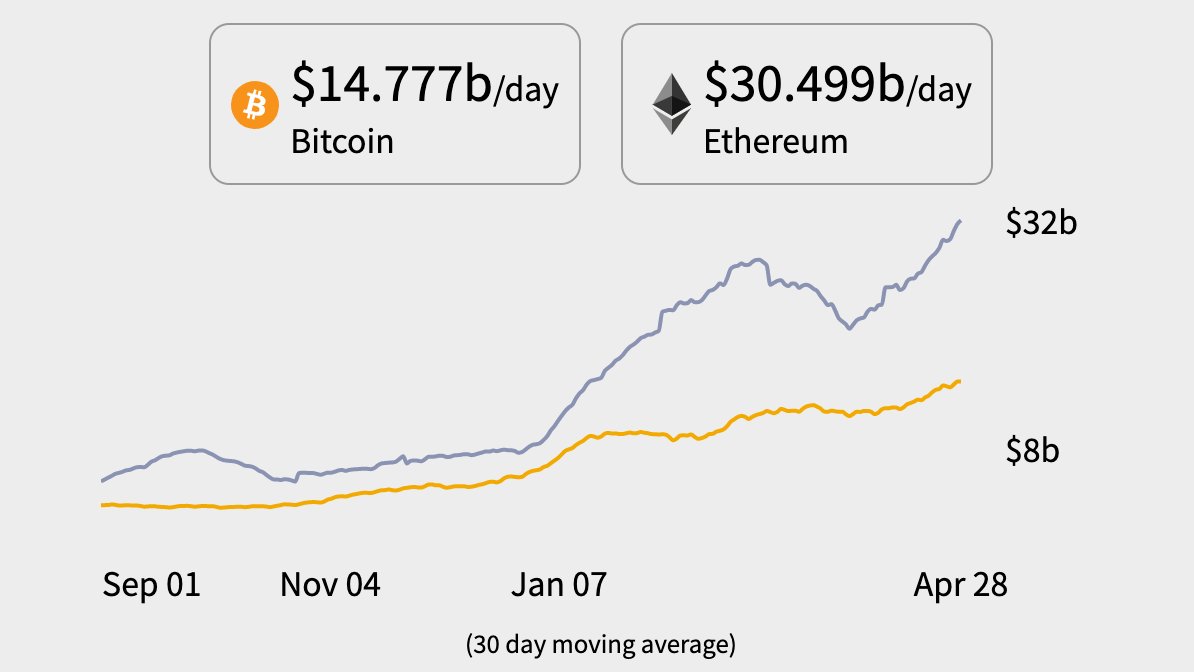

According to data analytics platform Skew, the recent ETH price rally coincides with an increase in spot trading volumes since mid-April.

Ether spot volumes have materially picked up since mid-April pic.twitter.com/3WqHlWdsl7

— skew (@skewdotcom) April 29, 2021

Analysts are optimistic about the ETH price surge, predicting that it will continue in the near future. A majority of market participants expect that the Ethereum price will rise to $10,000 or higher by the end of the year.

Bitcoin has crossed $58,000 in the last few hours and is now very close to $60,000, a high psychological level that will be critical to surpass in the coming days.

Bitcoin and Ethereum aren’t the only virtual currencies that are rising in value. Binance Coin (BNB), Dogecoin, and Litecoin are all up. Binance Coin has risen by over 2% in the last 24 hours, bringing it up to $627.

Dogecoin continues to draw buyers, and it is now trading at $0.36, up more than 17%. After surpassing $272, Litecoin, the digital asset generated by Charlie Lee, is up 3.14 percent from yesterday.

Related article | Ethereum Consolidates Above $2,700, Here Are Chances of Downward Move

Fundamental Reasons For ETH To Hit $10K

Market analyst ‘Spencer Noon’ has provided the top-ten reasons why Ethereum holds the potential to hit $10,000 by the end of 2021.

- There’s a massive demand currently for the ETH block space as the Ethereum blockchain overshadows its peers with the average daily fee paid around $18 billion.

- NFT sales on Ethereum have been skyrocketing and have recently surpassed $600 million.

- Ethereum-based Polygon network currently processes $1 million in daily transactions. It has also onboarded some of the biggest DeFi projects like Aave.

- The Ethereum blockchain network currently has more than $50 billion in outstanding stablecoin supply.

- As of date, the Ethereum blockchain network settles $30.5 billion of value every day which is twice that of the Bitcoin blockchain network.

- The daily active addresses for Ethereum are on a continuous rise and have reached a new all-time high above 625K in recent times.

- Ethereum is slowly emerging as an institutional-grade technology with the explosive growth of the DeFi activity this year. Of the total $65 billion locked in DeFi, a majority of the DeFi projects are on Ethereum.

The Ethereum community is now waiting for the ETH 2.0 update to be launched. As a result, ETH could grow to become one of the world’s largest blockchain networks. Several projects have moved from Ethereum to the Binance Smart Chain (BSC) in recent months, attracting a slew of new Decentralized Finance (DeFi) projects.

Ethereum may be able to reclaim its supremacy in the DeFi market with ETH 2.0. With cheaper and faster transactions, the world’s second-largest blockchain network may once again become home to the most widely used and powerful dApps, attracting users from Binance Smart Chain who previously used Ethereum.

Related article | Ethereum Closing In on $2,800 As ETH 2.0 Deposit Contract Hit New ATH

Featured image from Pixabay, Charts from Tradingview.com