The electronic payments fintech Square Inc. proved with numbers that Bitcoin is good for business, and its financial results are the best evidence.

Square Inc.’s quarterly sales more than tripled, thanks mainly to the recent interest in cryptocurrencies by the general public.

Bitcoin Means Business

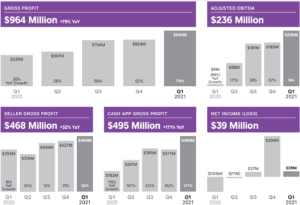

In a letter to its shareholders published this week, Square Inc. revealed that in the first quarter of 2021, it achieved a gross profit of $964 million, representing a 79% increase year over year. The company also reported that sales processing revenues totaled $468 million, up 32% year over year and that Cash App generated a gross profit of $495 million, which was 171% more year over year.

Square Financial Results. Image: Square

Square Financial Results. Image: Square

The company revealed that much of its revenue is due to the growing attractiveness – and price – of Bitcoin:

In the first quarter of 2021, total net revenue was $5.06 billion, up 266% year over year, and, excluding bitcoin revenue, total net revenue was $1.55 billion, up 44% year over year.

The financial results show that Square’s bet was successful, and the risk taken was worth it, considering that it managed to generate in one year what would be expected for 3 continuous years of activity.

Square’s Bitcoin gross profit was only $75 million, mainly due to the profits obtained from payment processing:

During the first quarter of 2021, we saw significant growth in bitcoin revenue year over year. While bitcoin revenue was $3.51 billion in the first quarter of 2021, up approximately 11x year over year, bitcoin gross profit was only $75 million, or approximately 2% of bitcoin revenue.

However, Square Inc. recognized that such results are not always replicable. As a result, what it earns from its bitcoin trading activities will depend mainly on its users’ price, interest, and habits.

The Love Story of Square and Bitcoin

Square is an openly pro-bitcoin company. Its CEO, Jack Dorsey, who is also CEO of Twitter (the leading social network in the crypto-verse), is a confessed bitcoiner who has assured on several occasions that Bitcoin could eventually be a globally adopted cryptocurrency in the internet of the future.

In October 2020, Square announced the purchase of 4,709 bitcoins for a total of $50 million. This decision was crucial for Bitcoin’s historic bull run that took it to new highs.

Other major companies like PayPal -which announced support for the purchase and sale of cryptocurrencies— soon replicated this move. MicroStrategy and Tesla sealed Bitcoin’s fate shortly thereafter, fueling a surge of unique dimensions in Bitcoin’s history.

Later on, in february of 2021 Square purchased an additional $170 million in Bitcoin, increasing its holdings to over 8.000 BTC —which is over $450 million today.

Pretty good eye for business opportunities.