2020 was unforgettable, especially for Bitcoin. To help memorialize this year for our readers, we asked our network of contributors to reflect on Bitcoin’s price action, technological development, community growth and more in 2020, and to reflect on what all of this might mean for 2021. These writers responded with a collection of thoughtful and thought-provoking articles. Click here to read all of the stories from our End Of Year 2020 Series.

2020 has been the most maniacal year in recent history. The world just can’t decide how to end itself, and is schizophrenically jumping back and forth between crises. It’s a shitshow, and it has seemingly plunged the world into a pit of chaos.

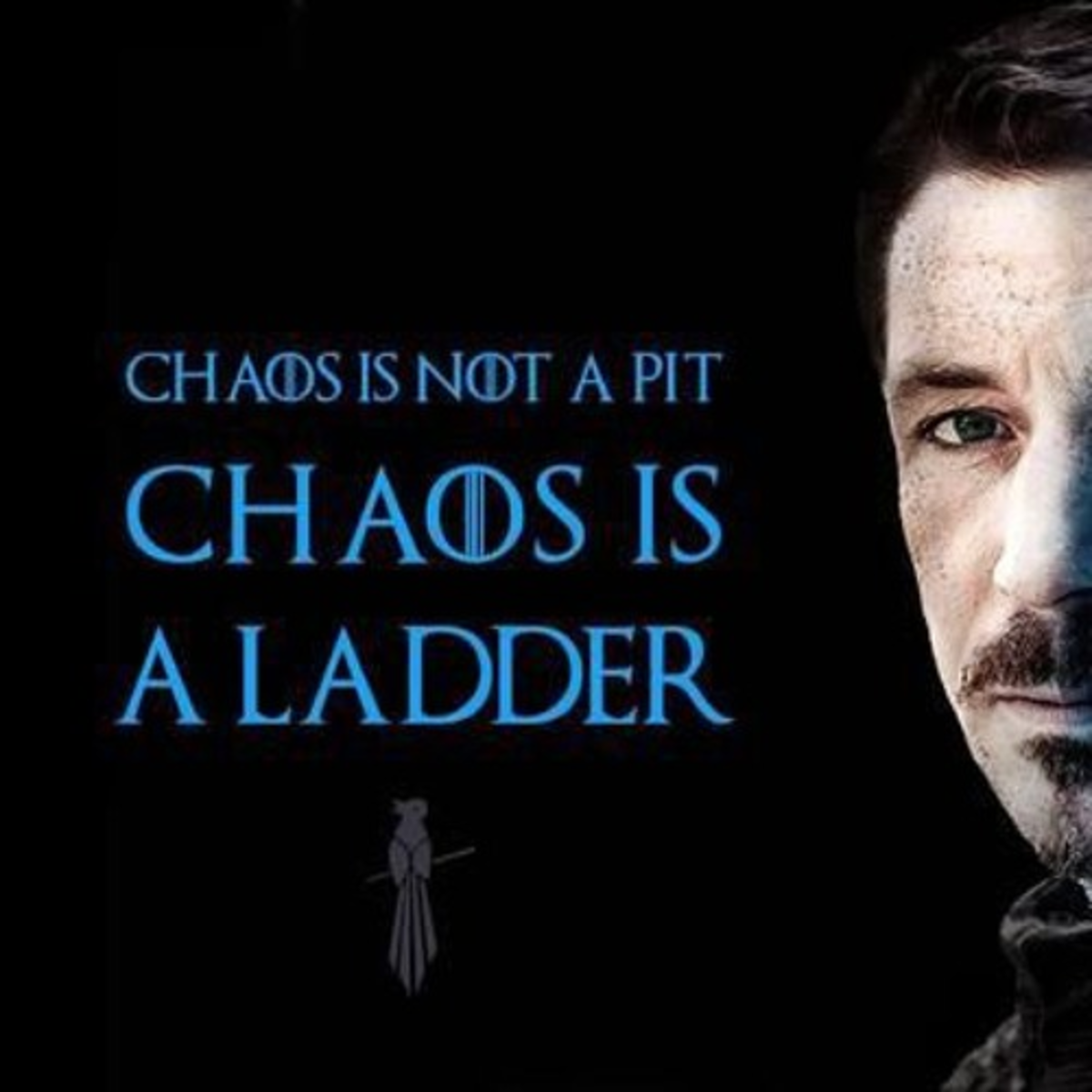

Chaos, however, isn’t a pit, as Littlefinger pointed out to us in “Game of Thrones.” Chaos is a ladder.

Bitcoin has benefited from the ladder of chaos this year, establishing new use cases and champions. New deep thinkers have entered the space, creating content that makes it easier for new Bitcoiners to travel down and through the rabbit hole. Central bankers worldwide have gone completely off the deep end with money printing, and Bitcoin has established, with no uncertainty, its use case as a treasury reserve asset for corporations.

The three most stunning thought leader additions to the space this year have been Robert Breedlove, Jeff Booth and Lyn Alden. Each one has contributed something unique to the space which has had a significant impact on the framework I use to understand Bitcoin, its place in the world and its place in history.

Robert Breedlove, The Number Zero And Bitcoin

This year, Breedlove helped organize my mental framework for Bitcoin’s place in history, and the magnitude of impact this invention will have on humanity writ large.

Two weeks after every market in the world puked (March 14), Breedlove dropped “The Number Zero And Bitcoin.” I printed the paper out at work, so that I could read it during any down time I had. I read it twice that day, once again the next day, and Guy Swann has read it to me at least twice since.

Before this moment, I had not come across a thinker who established the correct magnitude of how important an invention Bitcoin is. Breedlove drops the history of the invention/discovery of the number zero, and the massive improvements to human society that came as a result of its invention/discovery. The TL:DR is that zero has allowed for step-function-sized improvements in productivity and creativity in everything humans do. Breedlove’s point is that Bitcoin will provide similar exponential gains in creativity and productivity across all human endeavors.

Jeff Booth, The Price Of Tomorrow

The king of exponential thinking this year was Jeff Booth. Booth wrote a book, “The Price Of Tomorrow,” in which he expounded on the dichotomy between the exponential and deflationary nature of technology and the exponential inflationary trends of money printing in debt-based fiat markets.

Exponentials are difficult for the human mind to grasp, but exponential trends are found throughout nature, from the growth of a single-celled embryo to a fully-functioning baby, to the way hurricanes develop. Booth uses a thought experiment and asks his reader to guess how thick a piece of paper folded on itself 50 times would get. Spoiler alert: it would be thick enough to go from the Earth to the Sun.

Booth goes on with the folded paper metaphor to explain how technology is exponentially dropping the cost of things across the planet, making everything cheaper and easier to obtain. This deflationary pressure from the advancement of technology is pushing up against the opposing force of monetary inflation from central banks. In order to keep the fiat banking slavery system alive in the face of exponential deflationary pressure from technology, the banks need to print more and more money. These practices are skewing open-market price signals, and creating gross misallocations of capital throughout the global economy.

Booth argues, and he is right, that the only way to map the technological deflation to the economy to give true pricing signals is by grounding all economic calculation through an absolutely scarce commodity, bitcoin. Booth argues that the Cantillon Effect, which inflates asset prices, has grossly mispriced assets across the globe to the tune of about 90 percent of their value. Said a different way, there is a repricing event in our future where your $500,000 house would drop to a value of $50,000.

Lyn Alden, Describing The Puzzle

The plumbing of how this inflationary money system works has been laid out by Lyn Alden in a number of papers and podcast appearances this year.

Alden is the first person I’ve read who is able to describe how each piece of the puzzle affects another, and how this Rube Goldberg financial machine is likely to affect different asset classes, governments and people. The TL:DR for Alden’s work is that she’s super smart and able to bring her concepts and ideas to the masses in a way that is understandable. Alden is also of the opinion that central banks and governments across the world have backed themselves into a corner with financial obligations that will require them to print more and more money.

The U.S. financial markets suffered some serious shocks in September 2019 with the repo market crisis, which allowed the Federal Reserve to do some stealth money printing to keep banks solvent. This was just the opening salvo going into 2020, and the Federal Reserve got a windfall when the COVID-19 lockdowns began. To keep the entire system solvent, it was going to have to enact quantitative easing (QE) anyway, and it got to mask this inflation of the USD supply by more than 20 percent under the guise of supporting the economy through the COVID-19 crisis.

You can watch Booth’s predicted exponential growth of the monetary base play out in real time on the Fed’s own website. The last financial crisis saw total assets on the Fed’s balance sheet grow from roughly $1 trillion to $2 trillion, and this financial crisis has already grown the balance sheet from $4 trillion to $7 trillion.

If Booth and Alden are proven correct in their analyses, then this vertical line at the right of the balance sheet chart is just the beginning of an exponential move upward, and a new $1 trillion-ish spending bill trying to make its way through the U.S. Congress right now is another indication that Booth and Alden are correct. The next set of lockdowns will provide the cover needed to bail out zombie corporations and illiquid markets with more QE.

Inflation is coming. Expect it.

Michael Saylor, Derisking Institutional Bitcoin

Booth and Alden aren’t the only ones who see exponential inflation on the horizon. Microstrategy CEO Michael Saylor shocked the Bitcoin space this summer when he announced that his company was moving to a Bitcoin Standard, and holding bitcoin as its main treasury reserve asset.

The genius part of this move was that it was sold as a defensive strategy. Saylor didn’t want to lose the purchasing power of his company’s assets through central bank counterfeiting, so the company now holds an asset that can not be debased. Framing his bitcoin purchases in this way derisked the move for other public and private companies.

At the time of this writing, Microstrategy is holding roughly $700 million in bitcoin, and plans to purchase $650 million more in the near future. Saylor seems to have kicked off a new round of game theory mechanics with his purchases, as Square, MassMutual, Riot and Stoneridge either made bitcoin purchases of their own or disclosed that they had bitcoin on their corporate balance sheets already.

These corporations are all playing a game of musical chairs now. It’s a race to see who can get the most bitcoin on their balance sheets to protect their companies from the devaluation of their assets through exponential monetary inflation. This is good for Bitcoin.

Demand for bitcoin is currently outpacing the release of new coins being produced by the miners, and the macro trend seems to be that these purchased bitcoin are leaving the exchanges and going into cold storage.

There is an incoming supply-side liquidity shock. This is good for anyone holding bitcoin long term. Simple demand/supply economics will take over at some point, and drive the fiat-denominated value of bitcoin through the proverbial roof.

The exponential nature of the deflationary tech and inflationary money printing is going to have an effect on the price of bitcoin that will shock most to the upside. Bitcoin is just climbing the ladder. Number Go Up.

This is a guest post by Greg Zaj. Opinions expressed are entirely his own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

The post These Bitcoin Leaders Saw Ladders In 2020’s Chaos appeared first on Bitcoin Magazine.