Ethereum’s landscape has been evolving significantly throughout the past few months. In addition to the transition to ETH 2.0 looming on the horizon, the crypto is also seeing a massive influx of new users due to the explosive rise in decentralized finance’s popularity.

Many new users are being lured into Ethereum-based DeFi programs due to the large yields being offered on some protocols like Compound, where users are leveraging ETH-based tokens to earn, in some cases, upwards of 100% APR.

One prominent fund manager is now noting that there are a few key factors related to this shifting Ethereum landscape that could provide it with a massive uptrend in the coming few months that alters its long-term trajectory.

Reason 1: High gas fees reflect demand for Ethereum blockspace

Ethereum has seen a massive surge in its gas fees in recent times, reflecting a growing demand for blockspace. The “yield-farming” DeFi trend is the likely suspect driving this.

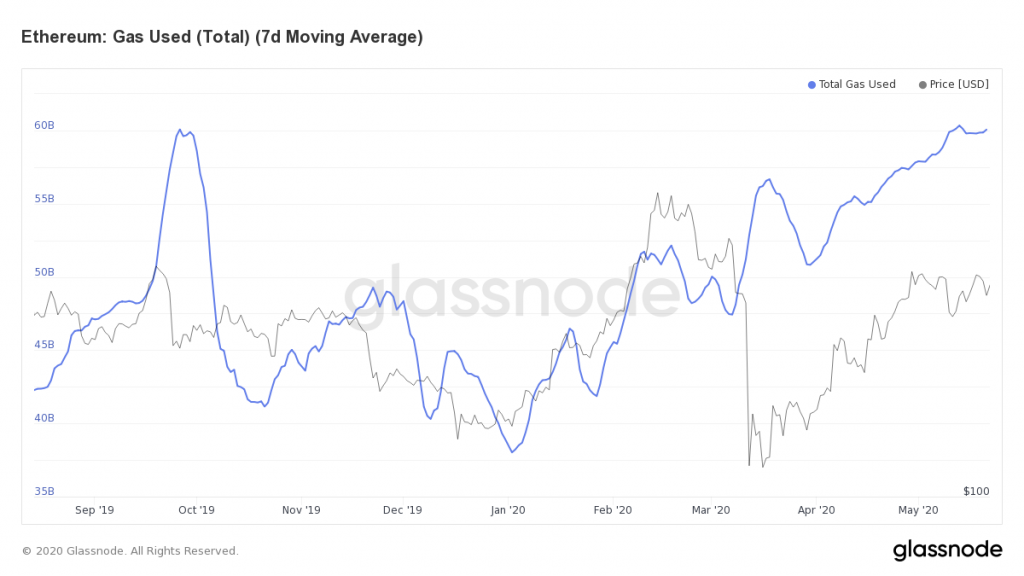

According to data from analytics platform Glassnode, the seven-day moving average of Ethereum’s total gas used has been climbing significantly throughout 2020.

Image Courtesy of Glassnode

Image Courtesy of Glassnode

This has also coincided with a spike in transaction fees, which have reached levels not seen in nearly two years.

Avi Felman, the head of trading at BlockTower Capital, recently explained that heightened demand for blockspace could ultimately lead to value accrual for ETH’s price.

“High gas fees on Ethereum reflect increased demand for blockspace. Whether ETH accrues value from this will be another debate that might capture mindshare. With EIP-1559 coming up this will only bring this narrative to more prominence and boldens the case for value accrual.”

Reason 2: DeFi has shown that crypto is more than “sound money”

Another reason why recent developments to Ethereum’s ecosystem could cause it so see immense strength in the coming few months is that many funds may buy ETH as a proxy to gain exposure to the DeFi ecosystem.

Felman speculated on this point, explaining that funds may be hesitant to deploy capital to small market cap tokens within this sector, instead just buying ETH.

“Large funds will have a hard time deploying to small + mid cap posns, so may buy ETH as a proxy.”

He also notes that Ethereum’s utility shows that cryptocurrencies are more than just hard-assets.

“DeFi has shown that crypto is more than just sound money, and soon individuals might pay attention to other ETH projects outside of DeFi…”

Reason 3: “Yield farming” to draw new users to ETH ecosystem

“Yield farming” has become a buzzword in the crypto world over the past several days and weeks, with investors widely leveraging Ethereum-based tokens to collect massive DeFi incentives.

In some cases, these incentives total at over 200% APR – although it is unlikely that rates of this magnitude will be sustained in the long-term.

While speaking on this topic, Felman notes that the lure of high returns with minimal risk via DeFi protocols could draw more people into the Ethereum ecosystem.

“Yield farming + liquidity mining *do* lock up ETH, but more importantly draw people from the general crypto ecosystem to the ETH ecosystem.”

Unless a sharp downside movement in the markets leads to mass-liquidation of collateralized DeFi loans, it is highly likely that this trend will continue gaining momentum in the mid-term.

The post Three reasons why the next few months are critical for Ethereum’s future appeared first on CryptoSlate.