How will companies be valued once bitcoin is universally used as a unit of account and measuring stick of worth?

Bitcoin will fundamentally change the way that investors value companies.

Upgrading monetary technologies is a radical paradigm shift that will leave many financial “experts” confused. Our current monetary system, the U.S. dollar, is based entirely on an ever-growing mountain of debt. In contrast, the Bitcoin monetary system is equity-based, with no counterparty risk and no dilution risk.

Once the world has completely embraced bitcoin as the superior monetary good, we will be living in a post-hyperbitcoinization world. Let’s experiment and see how a company will be valued using bitcoin as our unit of account or measuring stick of value.

Wyoming Red Ribeyes

The fictional company we will use for this example is Wyoming Red Ribeyes. It is a small cap, consumer staples, wholesale beef supplier that raises cattle and then sells premium beef to grocery stores in the U.S.

We will analyze this company with a discounted cash flow (DCF) analysis. Put simply, we attempt to predict the future cash flows the business will generate, and discount those cash flows to today’s value.

Two DCF models are created. One model is analyzing the company in a world where prices are driven by USD-denominated investors (today), and the other model is analyzing the company in a world where prices are driven by BTC-denominated investors (post-hyperbitcoinization).

USD-Denominated Model (Pre-Hyperbitcoinization)

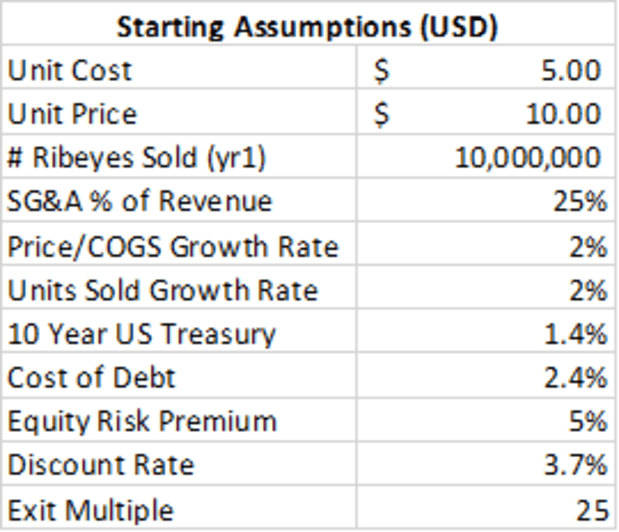

Before we create the full model, we need to lay out our assumptions.

First, let’s assume the current variable cost per ribeye produced is $5, and the price that Wyoming Red Ribeyes sell it for is $10. Based on previous years’ sales, we expect 10 million ribeyes to be sold this year. Other expenses, including selling, general and administrative expenses, historically equal about 25 percent of annual revenue.

Additionally, we expect its unit costs to rise 2 percent per year (consumer price index inflation), and it will pass that on to its customers by raising our prices 2 percent per year. It also expects to increase the number of ribeyes sold by 2 percent per year, as U.S. beef consumption is steadily growing.

Last, Wyoming Red Ribeyes expects to sell the business in 10 years at a price-to-earnings (P/E) ratio multiple of 25 (the S&P 500 Consumer Staples average), and it will discount its projected future cash flows back to today’s value using the company’s weighted average cost of capital (WACC) as its discount rate. This company is financed with 50 percent debt and 50 percent equity, with a cost of debt equaling 100 basis points (bps) above the risk-free rate (based on a 10-year treasury note) and an equity risk premium of 5 percent.

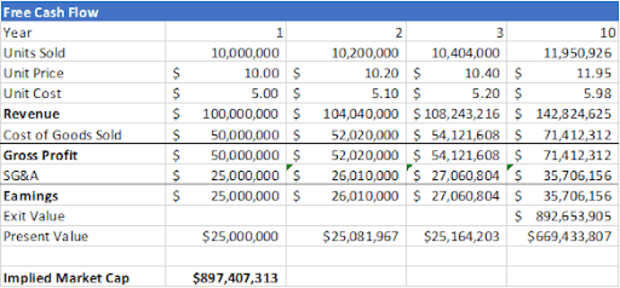

Above is the USD DCF model (hiding years four to nine for display purposes). Three things are very notable: One, we can see that revenue starts at $100 million and continues to grow over time. Two, earnings start at $25 million and also continue to grow over time. And three, the implied market cap is just below $1 billion.

BTC-Denominated Model (Post-Hyperbitcoinization)

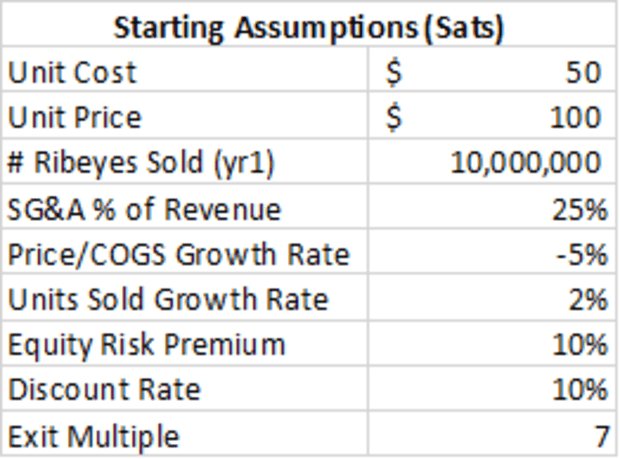

Before we create the full model, we need to lay out our updated assumptions since all prices will now be denominated in bitcoin.

First, we updated the unit cost to be 50 sats and the price at which Wyoming Red Ribeyes sells a unit to be 100 sats. This corresponds to roughly $5 and $10, respectively, at $10 million per BTC. Based on previous years’ sales, Wyoming Red Ribeyes still expects 10 million ribeyes to be sold this year. Other expenses, including selling, general and administrative expenses, historically equal about 25 percent of annual revenue. It is possible that this percentage would be decreasing over time, but for simplicity, we’ve kept it stagnant.

Unlike in our USD-denominated analysis, Wyoming Red Ribeyes can anticipate both its costs and its prices to decline by 5 percent annually. This is due to bitcoin’s natural deflationary nature allocating productivity gains to bitcoin savers. These productivity gains could be from an infinite amount of sources, including: automated energy production; self-driving delivery trucks; automated packaging and distribution; automated feeding, breeding and slaughter processes; or new software driving other unforeseen enhancements.

Last, Wyoming Red Ribeyes expects to sell the business in 10 years at a P/E multiple of seven, and we will discount our projected future cash flows back to today’s value using the expected equity risk premium under a Bitcoin standard, 10 percent. The P/E ratio is expected to be around seven and the discount rate is expected to be around 10 percent in order to better compensate the risk that the investor is taking relative to the new opportunity cost of simply HODLing bitcoin. The discount rate could possibly be higher and the P/E could possibly be lower.

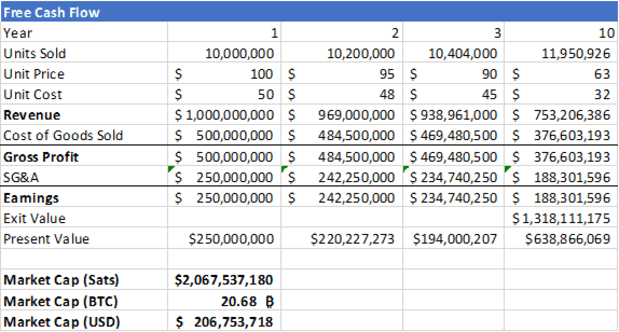

Above is the BTC DCF model (hiding years four to nine for display purposes). Four things are very notable: One, we can see that revenue starts at 10 BTC and continues to decline over time. Two, earnings start at 2.5 BTC and also continue to decline over time. Three, the implied market cap is just above 20 BTC. And four, and most notably, the real USD equivalent market cap is less than one-fourth the valuation in the USD-denominated world.

Bitcoin Swallows “Store Of Value”

As you might have expected, this massive drawdown in (real) valuation is simply taking the “store of value” aspect out of the equities, since that value will be stored entirely in bitcoin. However, it may be better to think that equities won’t fall in (real) value, but instead the amount of actual savings in the economy must increase by multiple orders of magnitude. I.e., the value per bitcoin must go very high.

Ultimately, bitcoin HODLers will be the ones who price equities in a bitcoin world, and they will be the ones who determine at what equity risk premiums they are willing to part ways with their bitcoin. The types of companies and projects that get funded in a bitcoin world will be high value, low time preference endeavours, as that will be the only way to obtain positive free cash flow.

The high equity risk premium doesn’t necessarily mean that fewer projects will be funded. It is likely that the value of bitcoin will rise so high that large HODLers will have so much wealth to fund all sorts of interesting ventures, while still retaining a significant amount of their BTC as savings.

Bitcoin will usher in a new era of price discovery for markets by eliminating government and central bank intervention, obliterating the idea of debt and allocating all risk free “store of value” wealth to bitcoin. It is likely that the amount of wealth humans will be willing to store in a risk free “store of value” asset with no counterparty risk and no dilution risk is incomprehensible.

This is a guest post by Mimesis Capital. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.