After facing a grim rejection at its newly established all-time highs of $8.45, Chainlink’s buyers have stepped up and are once again pushing the token’s price higher.

It is now venturing back into the $8.00 region, although it may face some heightened resistance once it nears its highs.

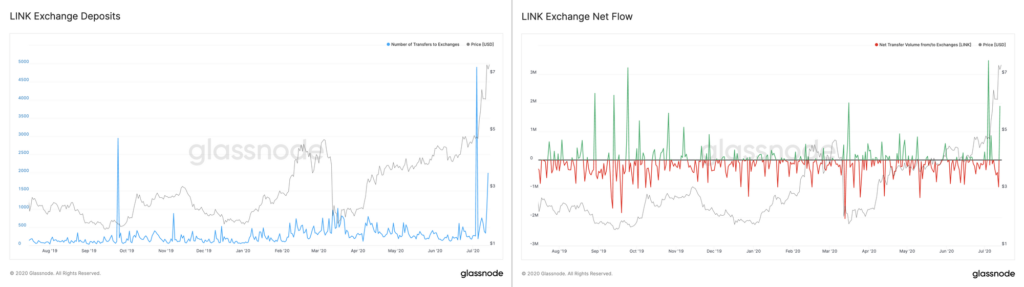

One set of on-chain data that seems to spell trouble for the crypto’s near-term outlook is the massive inflow of LINK into exchanges seen over the past couple of days.

Although this is typically a sign that long-term investors are preparing to offload their holdings, data suggests that the buying pressure currently being placed on the cryptocurrency far outweighs the selling pressure.

Chainlink pushes past $8.00 as exchange inflows grow

Chainlink is trading up over ten percent at its current price of $8.10. This marks a notable climb from its recent lows of $6.80 that were set at the bottom of its latest selloff.

Just a couple of days ago, the cryptocurrency was able to incur some massive momentum that sent it surging up towards highs of $8.45. The selling pressure here almost instantly caused it to reel down to its recent lows.

In tandem with this movement, inflows of LINK into exchanges rocketed, suggesting that investors were preparing to offload their holdings.

According to a recent report from the analytics platform Glassnode, Chainlink inflows into exchange wallets first started rising in early July, hitting an all-time high on July 4th.

They once again spiked on July 13th when the crypto set its highs.

“On July 4th, the number of LINK exchange deposits reached an ATH, with ~5000 individual deposits totaling nearly 4 million LINK (worth almost $19 million at the time)… Then, on July 13th, LINK exchange deposits spiked again… bringing net flow back into the positive numbers…”

Data Source: Glassnode

Data Source: Glassnode

LINK buying pressure is overwhelming sellers

With Bitcoin and other digital assets, spikes in exchange inflows are typically a bear-favoring sign.

In Chainlink’s case, Glassnode notes that the buying pressure driving its uptrend simply outweighs the selling pressure stemming from investors who are now taking profits off the table.

“Some market observers have pointed to the spike in exchange deposits as representing mounting sell pressure – but since these deposits occurred, the price of LINK has almost doubled, indicating even higher buy pressure.”

It is also important to note that this movement is being backed by massive organic trading volume.

Tyler Winklevoss, CEO and co-founder of Gemini, noted in a tweet that 15 percent of the exchange’s total trading volume yesterday was from its LINK/USD trading pair.

“Another big day for the LINK Marines as bull run continues. 15% of Gemini’s total volume today is LINK/USD. Wow.”

Because this latest push higher is backed by significant buying pressure, LINK’s bulls may be able to continue absorbing the heavy selling pressure it is currently facing and propel it even higher.

The post Why unprecedented exchange inflows aren’t stopping Chainlink’s momentum appeared first on CryptoSlate.